When my wife and I decided to open a Roth IRA, we faced the classic choice: Vanguard or Fidelity.

I’d like to share my experiences and give insights into these two giants in the investment world.

Platform Comparison

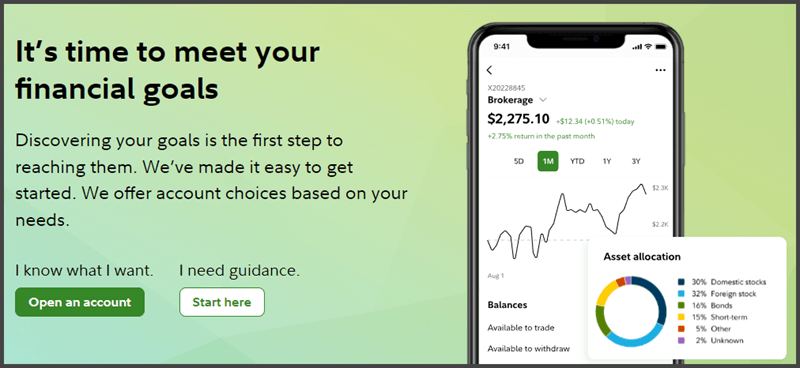

For me, the decision initially felt like choosing a favorite color. I settled on Vanguard for its intuitive mobile/desktop interface and, admittedly, my preference for red (this was at the beginning of my journey).

However, it’s money that we’re talking about here. The aesthetics can definitely wait.

Having been with Fidelity for over two decades, I can confidently say that their platform is incredibly user-friendly. The data analytics tools have been invaluable for my research needs. It’s no exaggeration to say that I’ve become a loyal advocate for Fidelity.

Customer Service

In contrast, my experience with Vanguard for my 401k left much to be desired. Their customer service proved to be a frustrating hurdle, taking months and countless hours on the phone to resolve a simple online banking issue.

Only after resorting to a negative review on their Facebook page did I finally get the attention I needed. Fidelity, on the other hand, has been a breeze to work with.

Index Funds

Vanguard’s requirement of 10k for access to certain funds can be a significant factor. Fidelity’s introduction of zero-fee funds like FZROX, the playing field has leveled considerably. It’s worth noting that other platforms, such as TD Ameritrade and Merrill Edge, have also made strides in reducing costs.

In my experience, Fidelity’s bond funds tend to have higher expense ratios than Vanguard equivalents, especially as my portfolio became more bond-centric. This is a significant factor for consideration, particularly for those nearing retirement age.

My preference leans towards Vanguard’s funds despite the allure of Fidelity’s zero expense ratio offerings.

The intricacies of dividend distribution timing play a role in my choice. Vanguard’s Total Stock Market Index Fund (VTSAX), with its 0.04% ER and quarterly dividend payouts, gives me more flexibility for reinvestment, ultimately leading to what I believe will be a slightly superior growth over the long term compared to Fidelity’s FZROX.

Pro tip: Don’t buy Vanguard ETFs in your Fidelity account because there is a transaction fee of $75. Use Fidelity’s equivalent ETFs.

Fractional Shares

While Fidelity and Vanguard have their merits, what sways me towards Fidelity is fractional investing. Vanguard may offer enticing index funds, but the overall experience with Fidelity feels more seamless to me.

The ability to purchase fractional shares on Fidelity is a game-changer, a feature that Vanguard doesn’t provide.

Update 10/25/22: You can now buy and sell fractional shares (by dollar amount) of Vanguard ETFs.

In Summary

Both Vanguard and Fidelity have their strengths and areas for improvement. For me, Fidelity’s seamless user interface, customer service, and the flexibility of fractional shares have won me over.