Are you considering a move from Vanguard to Fidelity? I’ve got your back!

The process is quite simple. Open a brokerage account with Fidelity, fill out the transfer request form, and Fidelity will do everything else for you. They even reimburse ACAT fees for eligible accounts.

Check out the tutorial below for a step-by-step guide on how to transfer from Vanguard to Fidelity.

1. Create a Fidelity Account

Head over to the Fidelity website and sign up for an account. If you use the promo code FIDELITY100, you’ll even snag a sign-up bonus.

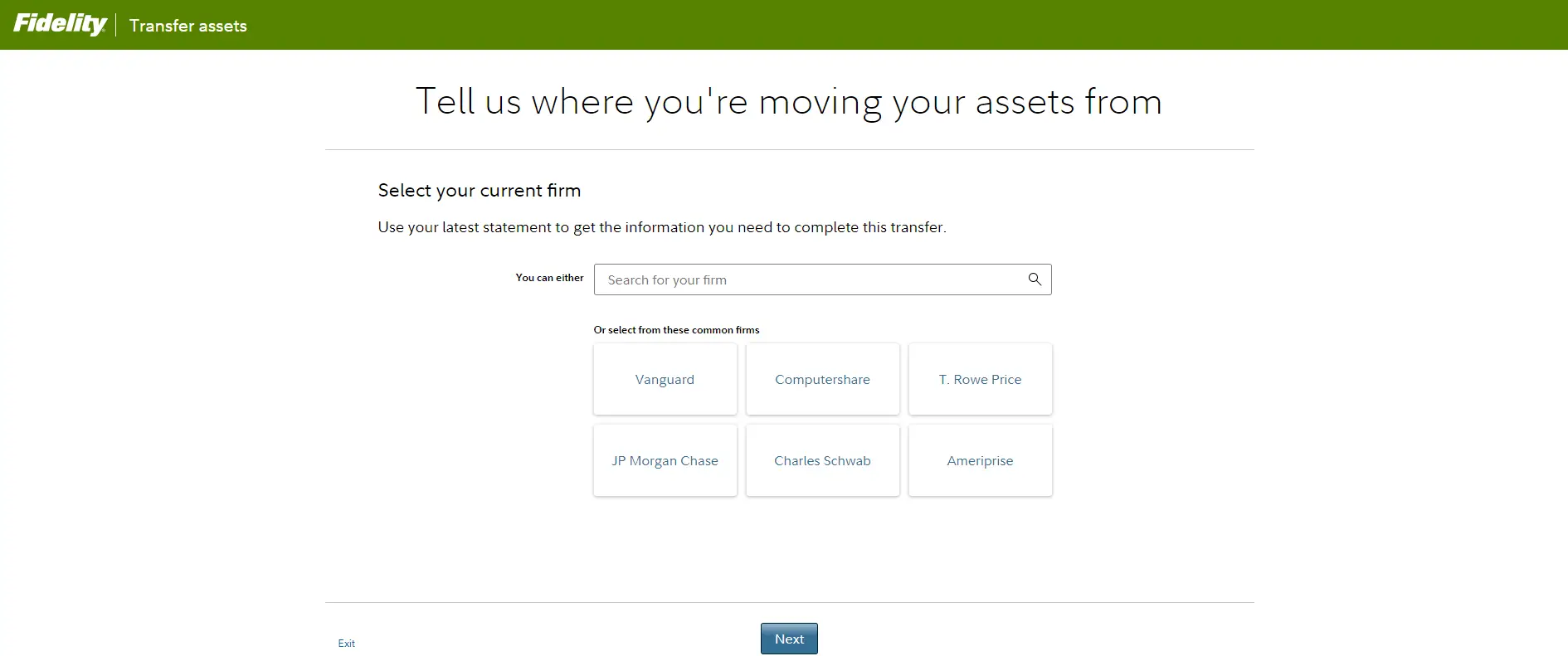

2. Fill Out the Fidelity Transfer of Assets Form

Once you’ve got your Fidelity account set up, fill out the Transfer of Assets form. This form is crucial as it’s the formal request to move your investments from Vanguard to Fidelity.

3. Provide Vanguard Account Details

Share your Vanguard account information with Fidelity. This step initiates the transfer process.

You will need to provide the following:

- Vanguard account number.

- Your account type (regular brokerage account, Roth IRA, 401k, etc).

- Is it a complete transfer or a partial transfer?

- A recent statement from Vanguard (Optional. For faster processing)

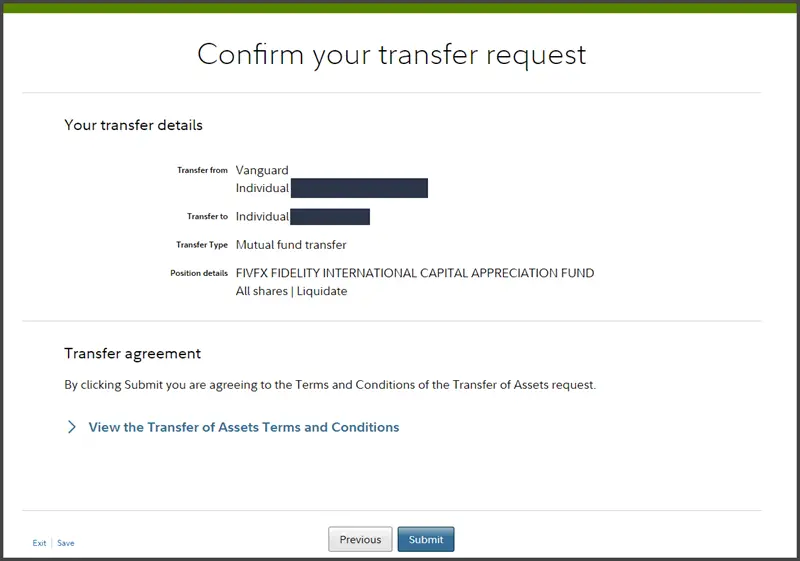

After filling out the Transfer of Assets form, you’re ready to submit it.

4. Wait for the Transfer

Now comes the waiting game. Usually, it takes about 3-5 days to transfer from Vanguard to Fidelity, but some accounts may take up to 2 weeks. To keep tabs on the status, you can use Fidelity’s Transfer Checker tool.

Why Fidelity Is Better Than Vanguard

Partial Shares: Fidelity lets you purchase partial shares, which can help maintain precise allocations in your brokerage account.

User Interface: There were differing opinions on the user interfaces of Vanguard and Fidelity. Some users preferred Fidelity’s interface for its modern design and ease of use, while others found it a work in progress.

Cash Management and Credit Card Benefits: Fidelity offers cash management features, including a debit card linked to your account. They also provide a 2% cash-back credit card.

Reimbursement of Transfer Fees: Fidelity generally reimburses transfer fees imposed by other institutions. This perk is automatically included for account holders with over $25,000.

And there you have it! With a bit of patience, moving your assets from Vanguard to Fidelity can be a cakewalk.

Rollover Options

If you’re transitioning from Vanguard’s target date funds to Fidelity, you’ve got a couple of choices:

- Keep your Vanguard holdings as they are even after they’ve been moved to Fidelity.

- Opt to sell your existing Vanguard portfolio and replace it with similar Fidelity funds.