Someone asks:

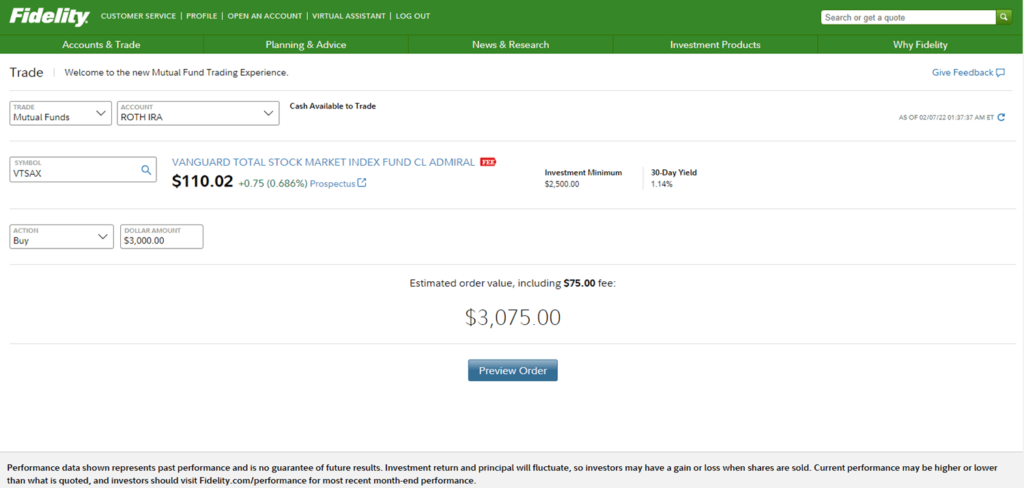

I’m looking at VTSAX on Fidelity, and it says there is a $75 transaction fee. Does this fee apply per transaction or just for the initial purchase of the fund? I’m trying to compare VTSAX and FSKAX to decide which one to invest in.

FSKAX and VTSAX are mutual funds that invest in a variety of stocks. View them as a total stock market index fund, which means they hold stocks from all sectors and market caps. But which one is better? Find out in the comparison below.

Underlying index

Fidelity’s Total Stock Market invests 80% of its assets in stocks from the Dow Jones US Total Stock Market Index while Vanguard’s VTSAX focuses on the CRSP US Total Market Index. Different indexes but the same overall goal.

Fund issuer

FSKAX is a mutual fund from Fidelity. VTSAX is a mutual fund from Vanguard.

Transaction fee

One factor to consider when choosing between FSKAX and VTSAX is the transaction fees associated with each option. If you decide to invest in VTSAX through Fidelity, you will be charged a transaction fee.

There is no transaction fee for FSKAX since it’s a fund offered by Fidelity.

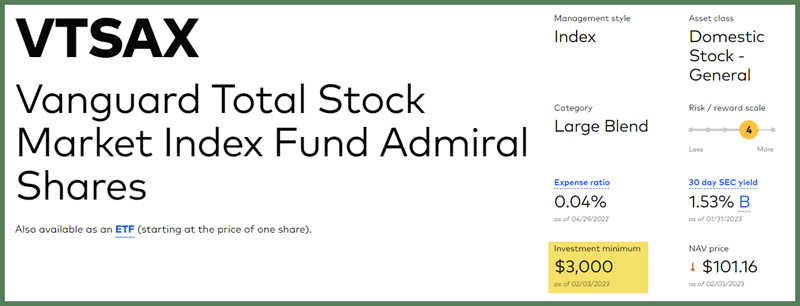

Expense ratio

In terms of cost-effectiveness, FSKAX has a lower expense ratio of 0.02% compared to VTSAX’s expense ratio of 0.04%. This could result in lower overall costs for investors in the long term.

Dividend distribution

VTSAX pays dividends to shareholders every April and December. VTSAX pays dividends quarterly.

Minimum investment

If you are interested in investing in VTSAX, keep in mind that there is a minimum investment requirement of $3,000. On the bright side, FSKAX does not have a minimum investment requirement.

Type of fund

FSKAX and VTSAX have been classified as “Large Blend” funds by Morningstar, meaning they have similar compositions. This classification refers to funds that invest in a mix of large-cap growth and value stocks, providing investors with a balanced portfolio.

Top 10 holdings

The top 10 holdings for both funds are remarkably similar. FSKAX and VTSAX have significant investments in tech giants like Apple, Microsoft, and Amazon, as well as companies like Google, Tesla, Facebook, Nvidia, Berkshire Hathaway, and UnitedHealth Group.

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Apple Inc. | AAPL | 5.51% |

| Microsoft Corp. | MSFT | 4.69% |

| Amazon.com Inc. | AMZN | 2.11% |

| Alphabet Inc. Cl A | GOOGL | 1.49% |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.42% |

| Alphabet Inc. Cl C | GOOG | 1.34% |

| Tesla Inc. | TSLA | 1.28% |

| UnitedHealth Group Inc. | UNH | 1.26% |

| Johnson & Johnson | JNJ | 1.15% |

| Exxon Mobil Corp. | XOM | 1.14% |

FSKAX vs. VTSAX: Which Is Better in 2023?

VTSAX is a total stock market index fund. You can find equivalent Fidelity funds like FSKAX that have little to no fees and minimums.

You might already be doing this, but if you’re investing in Vanguard funds, it’s probably better to create an account at Vanguard rather than using your Fidelity account to buy them.

In your Fidelity account, FSKAX should give you the same returns as VTSAX, and you won’t have to pay the $75 fee.

💬 Community Discussion

Jason F:

If you want longevity, then switch to FSKAX which is literally Fidelity’s equivalent to VTSAX. If you want the “real” VTSAX, go with VTI. It’s the ETF version of VTSAX (literally the same exact fund, just with a different share class). VTI trades free at Fidelity.

David J:

Buying a Vanguard mutual fund for $75 at Fidelity is a waste of $75. Invest your $75 in FXKAX or FXROX, both are total market index funds.

FZROX has about 1,000 fewer stocks in it than FSKAX and VTSAX do. They are mostly small cap stocks and it make up a very small percentage of the portfolios of VTSAX/FSKAX. Returns of the three funds will be very similar but not identical.

Sean M:

Is FSKAX pretty much the same as VTSAX?

Essentially, yes. They both track the entire U.S. stock market, just using different indexes.

Both track the market very closely, and both are low-cost, so I don’t expect investors will notice any meaningful difference between the two long-term. They’re very competitive with each other.