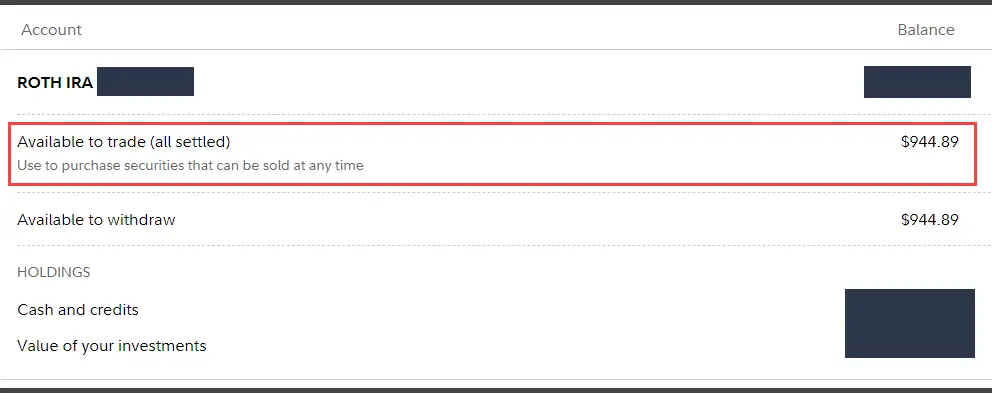

As a Fidelity customer, it’s important that you understand the difference between “Settled Cash” and “Cash Available to Trade.”

They can provide useful insights into how much money you have invested and how much cash is still available to trade.

Fidelity Settled Cash vs. Cash Available to Trade

Settled Cash represents the amount of money in your Fidelity account that’s entirely cleared and available for trading without any restrictions. Securities bought using settled cash can be sold at any time.

Cash Available to Trade is the amount you can use immediately to buy things like stocks, options, and ETFs. Think of it as your spending money for trading. But remember, this cash might not be fully settled yet.

Trading with Unsettled Cash on Fidelity

One of the common questions that arises is: does Fidelity let you buy stocks with unsettled cash? The answer is yes, but there’s a caveat.

If you use this money to buy securities, you must hold onto those stocks until the funds fully settle. The settlement period on Fidelity is T+2 (trade date plus two days).

Also, if you’re eyeing stocks that cost less than $3.00, there might be some restrictions.

Time Matters: Waiting for Your Money

After making an initial deposit on Fidelity, cash typically takes about 7 business days to fully settle. This period is standard for new customers, and it directly impacts their ability to make trades.

While trading with unsettled cash is possible, always ensure you understand the settlement periods to avoid any unintentional Good Faith Violations.