Someone asks:

Is Fidelity strict with good faith violations? I have yet to sell with unsettled cash on their platform. I understand that you are not supposed to, but Webull does not enforce GFV punishment unless you sell $1,000 or more unsettled (although their policy states otherwise). I was just curious as to whether Fidelity had the same leniency?

Good faith violations (GFV) are enforced by every trading brokerage. It’s not just a Fidelity thing. A good faith violation happens when you buy a stock with unsettled cash.

Fidelity cash accounts have T+2 settlement period. When a stock is sold, the cash received will not be settled until 2 days later. Until then, you can’t use that amount to purchase another stock. You may proceed with the purchase if you have enough settled cash available to cover the new trade.

How Many Good Faith Violations?

Fidelity allows its customers to receive up to 3 strikes (good faith violations) within 12 months period. If you go over this amount, your account will be restricted for 90 days.

When your Fidelity account is restricted from Good Faith Violations, you will only be able to trade with settled funds.

How Many Good Faith Violations Do I Have?

Here’s how you can check.

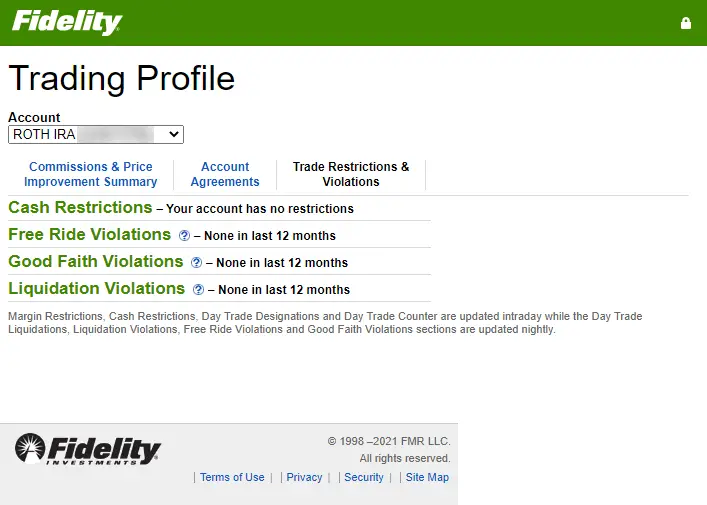

- Login to your Fidelity account.

- Click on Balances.

- Under Trading Profile, select Trade Restrictions & Violations.

On that same page, you can also check on your Free Ride Violations, Cash Restrictions, and Liquidation Violations.

How to Avoid Getting a Good Faith Violation

There are a few ways to avoid Good Faith Violations (GFV).

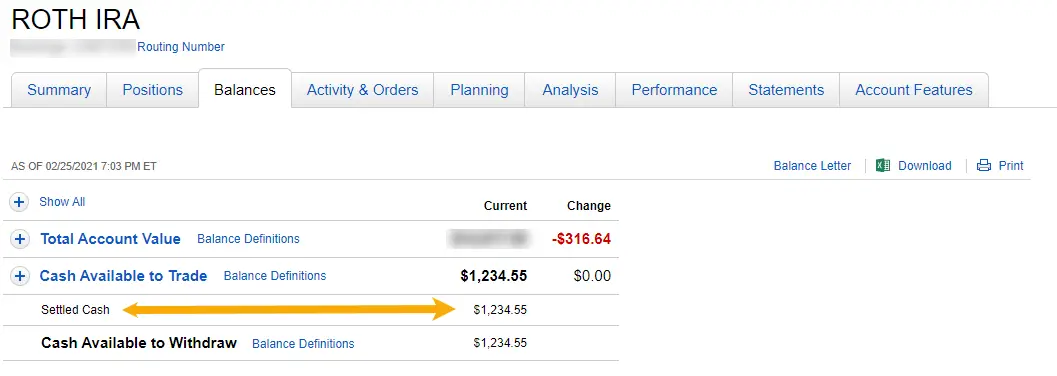

- Only buy and sell with settled funds. You view your total settled cash in Fidelity by navigating to the Balances tab.

- Don’t go over the limit. It’s okay to take a GFV strike when necessary, but do not go over the given limit. If your account has more than 3 strikes, it will be restricted.

- Wait for your initial cash to settle. Fidelity will let you buy stocks with unsettled funds, however, if you sell it before the initial balance is settled, it will trigger a good faith violation. You should wait at least 2 days before selling the stock.

- Get a margin account. We don’t recommend this to beginners, but it’s another way to avoid running into good faith violations.

💬 Community Discussion

Eddit M:

After purchasing an individual stock, how long does it take to “settle”? I am getting a warning regarding Good Faith Violation on a sell ticket because the share purchase on 6/12 is not yet “settled”. Is this unusual?

Justin H:

Is there a way around the T + 2 day settling time and avoiding a good faith violation? I’m paranoid about some of the quick money plays because, if I buy today and it jumps tomorrow, I can’t sell until after it settles. Thoughts? Answers? Thank you all.

Steven F:

Question regarding cash accounts and settled cash. I am new to doing my own trades through a fidelity cash account. Quite a few times, I have found myself essentially locked into holding a stock, wishing I could exit, as I watch my gains slowly dwindle. I get the flag regarding a potential good faith violation if I were to sell.

Samirov J:

You’d be much better off selling later. The quick buck may seem inviting but it’s nothing compared to some of the gains that you can get by holding. To answer your original question I don’t think there is a way to avoid that but I could be mistaken.

Dean P:

Have a margin account to avoid all the + 2 day problems and violations. 3 strikes and your trading on settled cash only in a cash account. And remember just because you have a margin account doesn’t mean u have to use the margin because it will get you into twice the trouble real quick!

Latu A:

You’re good with one good faith. Just can’t get 2 more within 12 months or you’ll be only allowed to use settled funds.

Daniel W:

If you’re doing it too much they will put you on a 90 day restriction to where you can only use settled cash for that 90 day period. I just got off the restriction today.