Balanced index funds are designed to achieve a mix of income and capital appreciation by investing in stocks and bonds. They are typically low-cost, tax-efficient, and relatively easy to manage.

If you are in the market for a balanced index fund, look no further. There are two outstanding candidates to choose from. We have Fidelity’s FBALX and Vanguard’s VBIAX.

Let’s find out which one you should pick for your portfolio.

FBALX vs VBIAX: What Are the Differences?

- The total net assets of the FBALX and the VBIAX are identical. However, the Vanguard fund is slightly bigger than the Fidelity fund (45.4 billion and 37.21 billion).

- The expense ratio of FBALX is 0.51%, while VBIAX’s expense ratio is only 0.07%. For context, If you had invested $10,000 in FBALX, the yearly fee would be $51.

- VBIAX’s minimum investment is $2,5000, whereas you can invest any amount with FBALX.

- The Fidelity Balanced Fund is more diversified (with over 5000 holdings) than VBIAX, which only has about 1,500 stocks in its portfolio.

FBALX vs VBIAX: How Are They Similar?

- FBALX is the Fidelity Balanced Fund, which is currently made up of 60% stocks and 40% market-weighted bonds.

- Similarly, VBIAX is the Vanguard Balanced Index Fund, it invests 60% of its assets in the CRSP US Total Market Index, and the rest follows the performance of the Bloomberg Barclays U.S. Aggregate Float Adjusted Index.

- Both funds were classified as Allocation–50% to 70% Equity by Morningstar.

- They distribute dividends quarterly.

FBALX vs VBIAX: Portfolio Composition

FBALX Top 10 Holdings

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Microsoft Corp. | MSFT | 4.79% |

| Apple Inc. | AAPL | 4.23% |

| Amazon Inc. | AMZN | 2.63% |

| Alphabet Inc. Cl A | GOOGL | 1.65% |

| Alphabet Inc. Cl C | GOOG | 1.56% |

| Meta Platforms Inc. | FB | 1.55% |

| NVIDIA Corp. | NVDA | 1.31% |

| UnitedHealth Group Inc. | UNH | 1.18% |

| Tesla Inc. | TSLA | 1.08% |

| Jabil Inc. | JBL | 1.04% |

VBIAX Top 10 Holdings

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Apple Inc. | AAPL | 3.48% |

| Microsoft Corp. | MSFT | 3.18% |

| Vanguard Market Liquidity Fund | 2.57% | |

| Amazon Inc. | AMZN | 1.81% |

| Alphabet Inc. Cl A | GOOGL | 1.09% |

| Tesla Inc. | TSLA | 1.07% |

| Meta Platforms Inc. | FB | 1.00% |

| Alphabet Inc. Cl C | GOOG | 0.99% |

| NVIDIA Corp. | NVDA | 0.88% |

| Berkshire Hathaway Inc. Cl B | BRK.B | 0.60% |

As of 12/31/2021

FBALX vs VBIAX: Annual Return

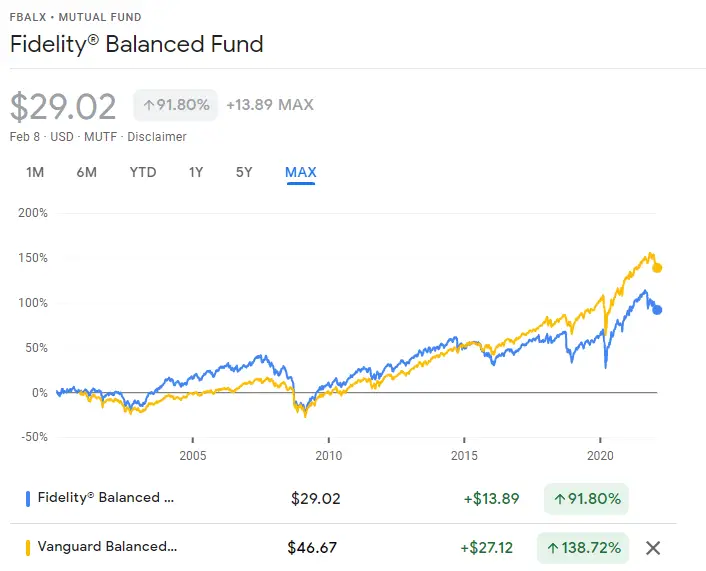

Both funds have had good returns over the past few years, but the Fidelity Balanced Fund is slightly higher.

| Funds | Fidelity® Balanced Fund | Vanguard Balanced Index Fund Admiral Shares |

|---|---|---|

| 1 month | -4.64% | -4.51% |

| 3 months | -3.11% | -3.16% |

| 6 months | +0.40% | -0.77% |

| 1 year | +13.51% | +9.61% |

| 3 years | +17.24% | +13.56% |

| 5 years | +13.49% | +11.06% |

Which is Better, FBALX or VBIAX?

You might want to go with VBIAX because it has a lower expense ratio than FBALX; 0.07% vs 0.51%, which can make a big difference over time.

If you’re investing with Fidelity, the statement above does not necessarily apply to you.

And here’s why:

- There is a transaction fee of $75 to purchase VBIAX on Fidelity.

- VBIAX has a minimum to invest of $2,500.

With that being said, it may be cheaper to invest in FBALX if you’re a Fidelity customer.

The bottom line is that both of these mutual funds are solid options to have if you want a mixture of growth and income.

Similar Comparisons

1 post – 1 participant