Someone asks:

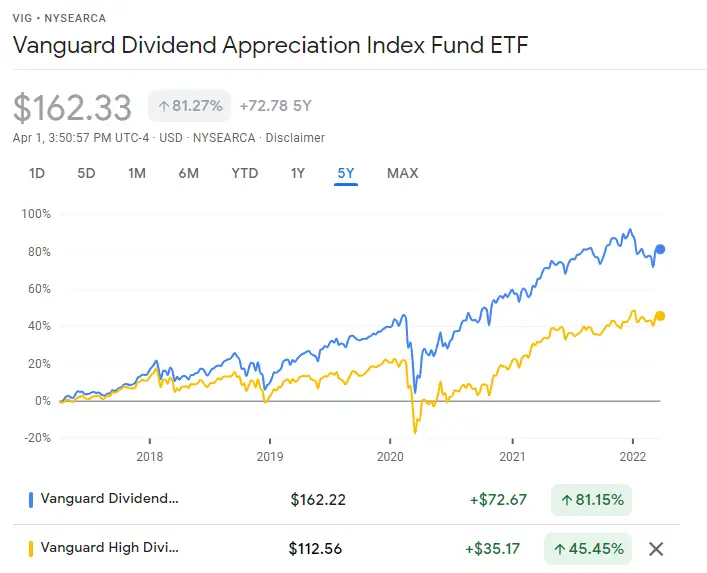

What’s the difference between VYM and VIG? Which is better to invest in? I want to hold it for 10 years, and I have a high-risk tolerance. Thank you.

VYM vs VIG: Fund Overview

| Funds | Vanguard High Dividend Yield Index Fund ETF | Vanguard Dividend Appreciation Index Fund ETF |

|---|---|---|

| Price | 112.34 | 162.06 |

| 3-year total return | +12.13% | +15.29% |

| 3-year standard deviation | 17.14% | 15.82% |

| Min. initial investment | $0 | $0 |

| Net expense ratio | 0.06% | 0.06% |

| Total net assets | 43.13bn USD | 64.12bn USD |

| Morningstar category | Large Value | Large Blend |

Which is Better, VYM or VIG?

Joe N:

VYM (Vanguard High Dividend) is an index of high yielding US equities, while VIG (Vanguard Dividend Appreciation) is an index of US equities that are projected to grow their dividend payouts in the future. VIG has fewer underlying equities than VYM.

Sal N:

I suggest the Vanguard Dividend Growth fund if you want to increase payouts and growth. Over the 10-year timeframe, it should serve you well, especially if you choose to reinvest the dividends.

There is nothing wrong with VYM, just a lower propensity for growth and a higher immediate dividend income stream.

John B:

VYM is specifically geared toward stocks with an above-average dividend yield and is tilted toward value stocks. VIG follows an index of companies with a history of increasing their dividends, regardless of actual yield. It is considered a large blend fund, and its overall yield isn’t that much higher than that of the broad market.

VYM could be useful for someone who plans to spend all the income in the withdrawal phase. VIG could be useful for someone who wants a broad market fund with a tilt away from the tech sector. Neither one is useful for someone who thinks that dividends are free money.

Mike R:

VYM does have a higher yield, and it’s a fantastic diversifying complement to VOO.

VIG’s starting yield is lower, but the idea here is steadily increasing YoC—it’s a great option for a DGI strategy with built-in perpetual draw-down potential.

If you’re looking to maximize long-term performance, assuming a high-risk tolerance, you probably don’t want either, as they’re likely to follow the S&P 500 pretty closely.

Similar Comparisons

- SCHD vs. VYM

- FDVV vs. QYLD

1 post – 1 participant