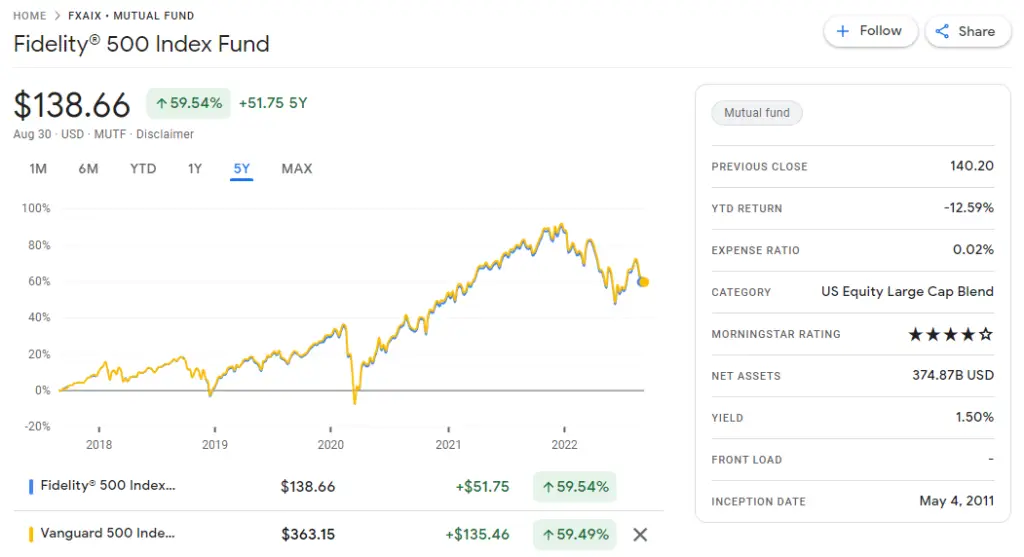

When it comes to ETFs tracking large-cap stocks, the two most popular options are the Vanguard S&P 500 ETF (VOO) and the Fidelity 500 Index Fund (FXAIX). Both funds offer low expense ratios and have performed similarly over the long term. However, there are some key differences between the two that investors should be aware of before making a decision.

The Vanguard S&P 500 ETF is a passively managed fund that tracks the performance of the S&P 500 Index. The fund is well diversified, with exposure to all 11 sectors of the U.S. economy. The top holdings in the fund include Apple, Microsoft, Amazon, and Facebook. The expense ratio for the Vanguard S&P 500 ETF is just 0.03%, making it one of the cheapest options available.

The Fidelity 500 Index Fund is also a passively managed fund that tracks the performance of the S&P 500 Index.

FXAIX: Fidelity 500 Index Fund

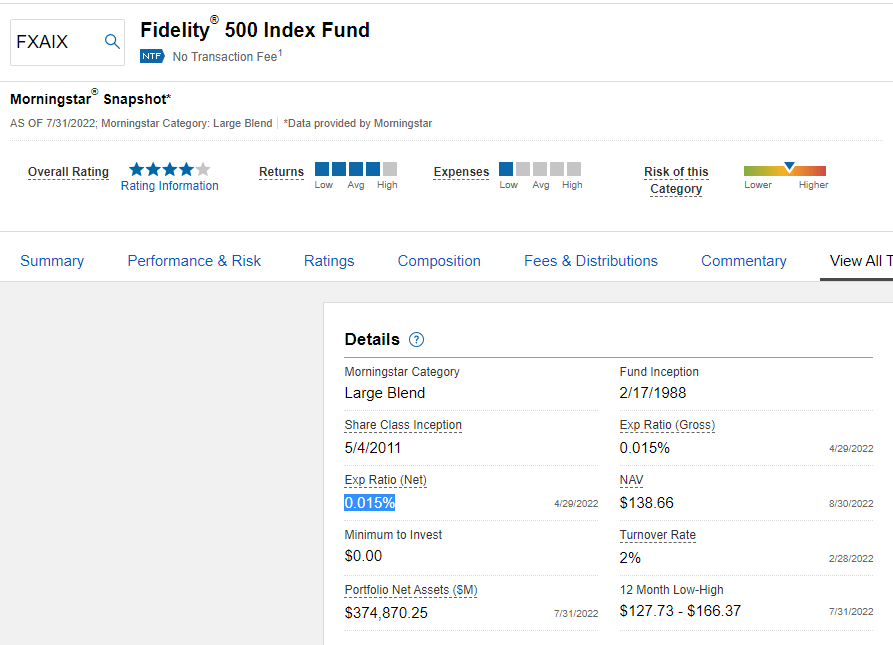

The Fidelity 500 Index Fund (FXAIX) is a low-cost index fund that tracks the S&P 500 Index, a broad benchmark for large-cap U.S. stocks.

The fund has a very low expense ratio of 0.015%, or $15 for every $10,000 invested, making it one of the cheapest options available. FXAIX is a good choice for investors who want to track the U.S. stock market but don’t want to pay high fees.

VOO: Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF seeks to track the performance of the S&P 500 Index.

The ETF invests in a portfolio of large- and mid-cap U.S. stocks that, in the aggregate, approximates the index’s holdings and weightings. The ETF is one of the largest and most popular U.S. equity ETFs, with over $250 billion in assets under management.

FXAIX vs VOO: Key differences

One of the biggest difference is that VOO is an exchange-traded fund (ETF), while FXAIX is a mutual fund. This means that VOO can be bought and sold like a stock, while FXAIX can only be bought at the end of a trading day. Another difference is that FXAIX has a slightly lower expense ratio than VOO.

When it comes down to it, both VOO and FXAIX are excellent choices for investors looking for a low-cost way to track the S&P 500.

FXAIX vs VOO: Which ETF is the better investment?

FXAIX and VOO holds a large basket of U.S. stocks, which are selected by a committee and weighted according to their market capitalization.

Winner: FXAIX