FZROX is the total market index fund that works like a mutual fund with no expense ratio. Would it not be more beneficial to get VTI fractional share at $11, which is the same price as a single FZROX share?

Just want the understand and learn the difference.

In this post, we’re going to compare the difference between Fidelity ZERO Total Market Index Fund (FZROX) and Vanguard Total Stock Market Index Fund ETF (VTI).

A few critical factors will be used such as expense ratio, dividend distribution, core holdings, and more.

FZROX vs. VTI: Expense Ratio

FZROX is a mutual fund from Fidelity with an expense ratio of 0% while VTI is an ETF from Vanguard with an expense ratio of 0.03%.

In this case, FZROX is cheaper than VTI in terms of fee structure.

FZROX vs. VTI: Dividend History

FZROX Dividend History

| Date | Per Share Amount | Reinvestment Price |

|---|---|---|

| 12/03/21 | $0.181 | $16.00 |

| 12/04/20 | $0.171 | $13.21 |

| 12/13/19 | $0.164 | $11.11 |

| 12/28/18 | $0.002 | $8.71 |

FZROX pays dividends at the end of each year.

VTI Dividend History

VTI pays dividends every quarter to its shareholders.

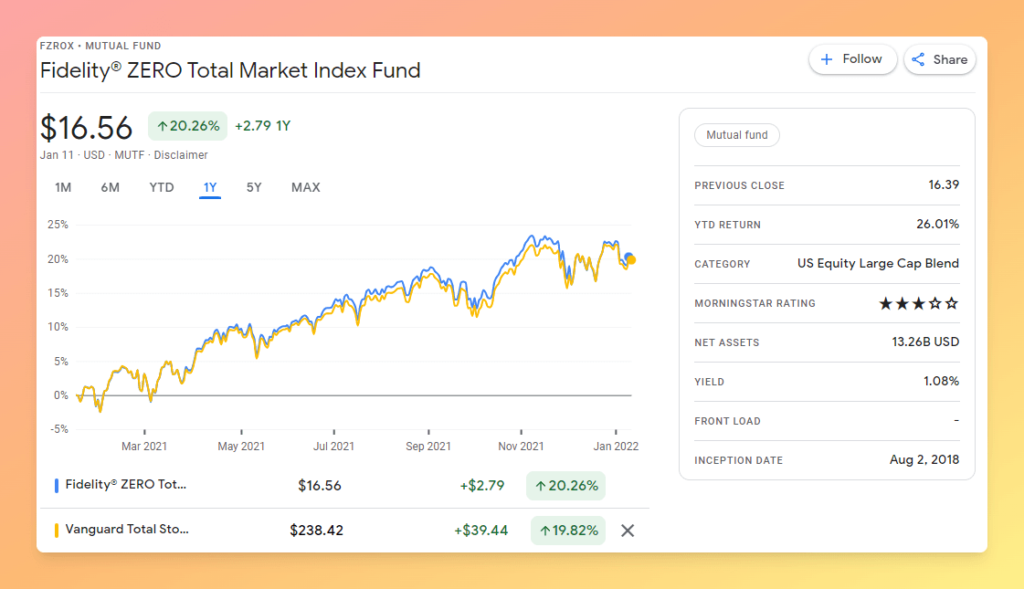

FZROX vs. VTI: Performance and Returns

Both FZROX and VTI are listed under Morningstar’s fund category of Large Blend. As a result, they have had similar holdings and performances over the years. But it’s not abnormal if one fund has a slight advantage over the other.

Check how FZROX and VTI performed in the last 5 years.

| Funds | Fidelity® ZERO Total Market Index Fund | Vanguard Total Stock Market Index Fund ETF Shares |

|---|---|---|

| 1 month | +3.97% | +3.81% |

| 3 months | +9.39% | +9.15% |

| 6 months | +9.39% | +9.08% |

| 1 year | +26.01% | +25.72% |

| 3 years | +25.81% | +25.76% |

| 5 years | — | +17.98% |

If You Invested $10,000 in FZROX 3 Years Ago, This Is How Much You’d Have Now: 19,914

If You Invested $10,000 in VTI 3 Years Ago, This Is How Much You’d Have Now: 19,889

FZROX vs. VTI: Which one you should invest in?

Here’s what Fidelity investors have to say about FZROX and VTI.

Joel C wrote –– June 1, 2020

FZROX uses a proprietary total market index, while I believe VTI’s is not. FZROX is also a proprietary mutual fund that can only be bought, sold and held at Fidelity which means you would have to liquidate the funds to move them to another broker.

FZROX is advertised as a zero cost fund, but that’s partly an accounting fiction. They do things like loan out shares to generate the funds needed to manage the fund. ETFs can do that to, but generally include the income in their accounting. FZROX is also much smaller than VTI, which gives it some tracking error that can be a problem; but FZROX has been growing exponentially, so that probably won’t be a problem in the future. The key take-away is probably that the cost difference between FZROX and VTI is just noise and you can ignore it for comparison purposes.

I actually own some shares of FZROX, but most of my total market holdings are in VTI and ITOT (for wash sale reasons). I only hold a few shares of FZROX to force me to follow what it’s doing. I think FZROX is find in a retirement account; but I’d avoid it in any taxable accounts because of the potential tax implications if you decided you need to leave Fidelity for some reason.

Joseph B wrote –– June 2, 2020

Fidelity’s own ETF offerings are very limited, just a handful of sector ETFs, some of them are quite good like FTEC (info tech), ONEQ (Nasdaq), and FHLC (health care).

Fortunately, Fidelity has a very close partnership with Blackrock iShares, and heavily advertise them on Fidelity’s platform. The Blackrock iShares total US market equivalent of VTI is a fantastic ETF called ITOT. It has an expense ratio of 0.03% and a low share cost of $69.