IVV and VOO are two popular S&P 500 ETFs, but which one is better?

In this article, we’ll break down the key differences between these funds to help you decide which one to buy.

| Funds | iShares Core S&P 500 ETF | Vanguard S&P 500 ETF |

|---|---|---|

| 3-year total return | +12.36% | +12.35% |

| 3-year standard deviation | 19.41% | 19.42% |

| Morningstar rating | 4/5 | 4/5 |

| Min. initial investment | — | — |

| Net expense ratio | 0.03% | 0.03% |

| Total net assets | 295.99bn USD | 263.69bn USD |

| Symbol | IVV | VOO |

| Morningstar category | Large Blend | Large Blend |

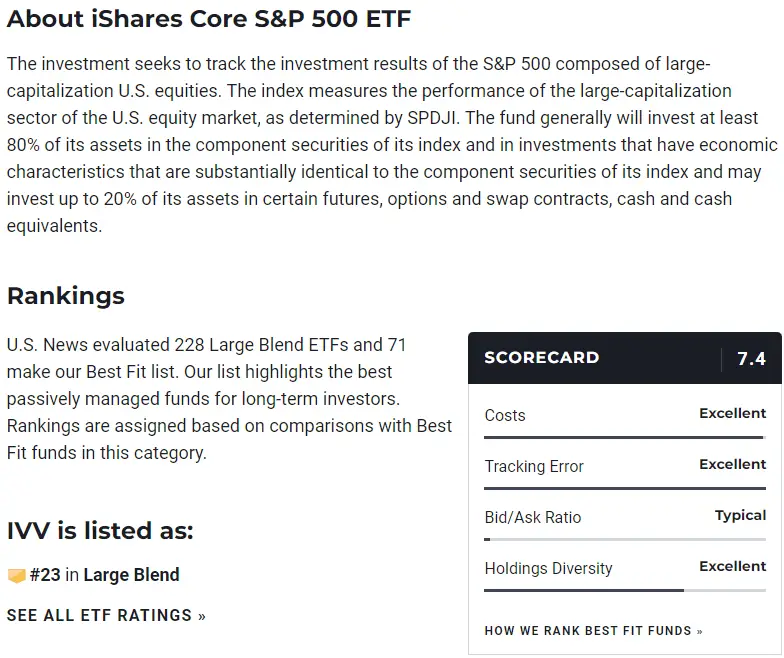

IVV: iShares Core S&P 500 ETF

You’re looking for an S&P 500 ETF that’s easy to buy and relatively inexpensive. The iShares Core S&P 500 ETF, ticker symbol IVV, is a good option.

IVV is a passive fund that tracks the S&P 500 index. That means it invests in all of the stocks in the S&P 500, just as they’re weighted by market cap, so it doesn’t try to beat the market with stock picking or market timing.

IVV has an expense ratio of 0.03%, which means you’ll pay about $4 for every $10,000 invested in this fund annually—a fraction of what most actively managed funds charge (about 1% or 2%).

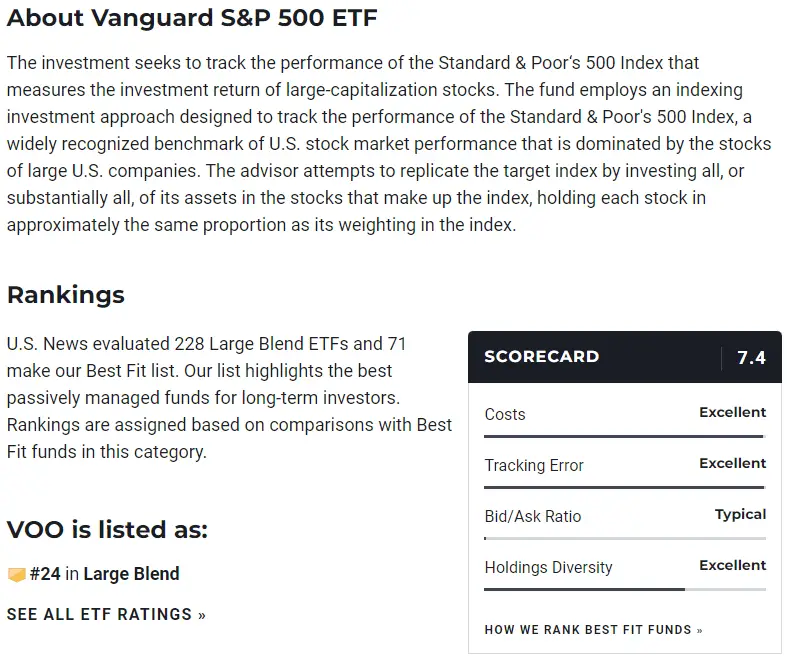

VOO: Vanguard S&P 500 ETF

Vanguard S&P 500 ETF (VOO) is one of the largest ETFs in the world, and it’s a low-cost investment option that seeks to track the S&P 500 Index.

With a diversified index fund like VOO, investors don’t have to worry about picking individual stocks or actively trading their investments.

VOO has an expense ratio of 0.03%, which is the same as its counterpart.

IVV vs VOO: Key differences

The key difference between IVV and VOO is that IVV is managed by BlackRock while VOO is managed by Vanguard.

Both funds have similar expense ratios and offer exposure to stocks on the S&P 500 Index.

There is no substantial difference between IVV and VOO other than who manages them.

IVV vs VOO: Which S&P 500 ETF Is Better?

It doesn’t matter if you pick IVV or VOO.

You’ll likely get the same performance and yields despite your decision. Either one is a no-brainer.

Our favorite: IVV