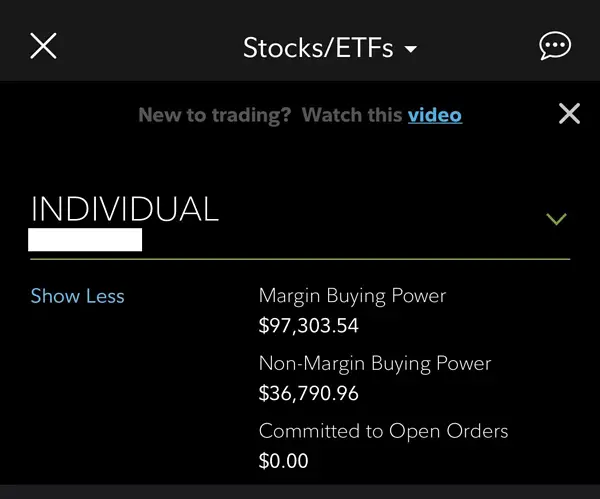

Non-margin buying power in a Fidelity account represents the amount of buying power a customer has in their margin account after accounting for any outstanding margin loans and collateral positions.

The amount is calculated by subtracting the total margin debt from the account’s cash and securities balance. This number can vary over time as the account’s balance changes.

Non-margin buying power can be useful for investors who want to purchase securities on margin but are concerned about the risk of a margin call.

By keeping track of their non-margin buying power, investors can ensure that they will still have enough equity in their account to meet any margin calls that may arise.

Community Comment:

Paul D:

This just shows how much non-marginable securities you can buy. Fidelity needs to do a better job at explaining its margin terms.

Non-margin buying power: This balance can be used to purchase securities that don’t allow for borrowing against them (i.e., those that have 100% margin requirement). This balance uses your cash and margin surplus from any margin-eligible securities already in the account, which means you can create a margin loan and borrow against those other positions to buy something that isn’t margin-eligible.

Similar Posts:

- Fidelity Intraday Buying Power: Read This Before Trading on Margin

- How to Change Your Fidelity Margin Account to a Cash Account

- Fidelity Margin Account Transactions Created Interest Charges

1 post – 1 participant