Someone asks:

Thoughts on Fidelity Puritan Fund (FPURX) vs. Fidelity Balanced Fund (FBALX)? Looking for a fund to deposit my stock profits with less downside risk in order to capture any of my realized stock gains. Trying to find comparable funds that I can buy through Fidelity that closely resemble Vanguard’s Wellington & Wellesley brands. Wellington is roughly 65/35 equities and Wellesley approx 35/65. Any suggestions? Thank you.

FBALX vs FPURX: Fund Objective

Fidelity Balanced Fund (FBALX) is a mutual fund that invests in stocks and bonds. This fund has an allocation of 60% stocks and 40% bonds. The fund invests in large, medium, and small companies with the objective to provide long-term capital appreciation and income.

Fidelity Puritan Fund (FPURX) is a no-load mutual fund that seeks long-term capital appreciation. The fund allocates around 50% – 70% in stocks and other equity securities—the rest in bonds and debts.

FBALX vs FPURX: Expense Ratio

Both mutual funds have the same expense ratio of 0.51%.

This means that for every $1,000 you have invested, $5.10 will be used to cover the fund’s operating expenses.

FBALX vs FPURX: Top 10 Holdings

Looking at their top holdings below, we can expect tech stocks to make up a large portion of the portfolio weight for FBALX and FPURX.

Some of the top holdings include Apple Inc. (AAPL), Microsoft Corporation (MSFT), and Amazon, Inc. (AMZN).

FBALX Top 10 Holdings

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Microsoft Corp. | MSFT | 4.85% |

| Apple Inc. | AAPL | 3.94% |

| Amazon Inc. | AMZN | 2.81% |

| Alphabet Inc. Cl A | GOOGL | 1.69% |

| Alphabet Inc. Cl C | GOOG | 1.61% |

| Meta Platforms Inc. | FB | 1.51% |

| NVIDIA Corp. | NVDA | 1.51% |

| Tesla Inc. | TSLA | 1.17% |

| UnitedHealth Group Inc. | UNH | 1.08% |

| Jabil Inc. | JBL | 0.89% |

FPURX Top 10 Holdings

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Alphabet Inc. Cl C | GOOG | 5.64% |

| Microsoft Corp. | MSFT | 4.46% |

| Amazon Inc. | AMZN | 3.34% |

| NVIDIA Corp. | NVDA | 2.50% |

| Apple Inc. | AAPL | 2.16% |

| Marvell Technology Inc. | MRVL | 1.93% |

| Meta Platforms Inc. | FB | 1.92% |

| UnitedHealth Group Inc. | UNH | 1.49% |

| Eli Lilly & Co. | LLY | 1.24% |

| Wells Fargo & Co. | WFC | 1.21% |

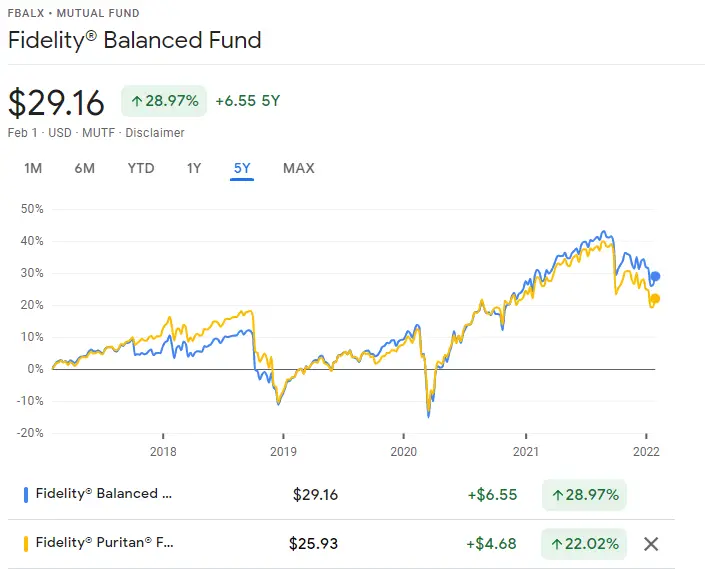

FBALX vs FPURX: Annual Return

| Funds | Fidelity® Balanced Fund | Fidelity® Puritan® Fund |

|---|---|---|

| 1 month | +3.04% | +2.35% |

| 3 months | +6.70% | +7.10% |

| 6 months | +6.42% | +6.41% |

| 1 year | +18.28% | +18.94% |

| 3 years | +21.67% | +20.25% |

| 5 years | +15.03% | +14.62% |

Which is Better, FBALX vs FPURX?

In terms of asset allocation, both funds are identical to each other (Allocation–50% to 70% Equity). Their top 10 holdings also suggest that they have a similar investing strategy.

FBALX isn’t cheaper than FPURX. They both actually charge the same yearly fee. As a result, the expense ratio isn’t a factor differentiating the two.

We conclude that you only need one fund in your portfolio. Either one will suffice, as they contain a mix of stocks and bonds that provide stability and growth potential.

Community Reviews:

Brian L:

They’re both very similar products with slight differences. I think owning one or the other would be fine. In my opinion, owning both would be a duplication of effort because their asset allocation and composition are similar.

Laura S:

FSPGX is a good low-cost large growth fund. There is no need for FBALX if you’re still young.

If you are looking for fixed income + stocks, you should consider FPURX.

Speak with a Fidelity Advisor who can give you more insight on how and when the dividends pay out.

1 post – 1 participant