If you want to keep your portfolio simple, two funds are worth considering: the Fidelity Large Cap Growth Fund (FSPGX) and the Fidelity 500 Index Fund (FXAIX).

FSPGX vs FXAIX: Fund Objective

FSPGX is a mutual fund from Fidelity that tracks the total return of U.S large-cap stocks. About 80% of assets under management are invested in securities in the Russell 1000 Growth Index.

On the other hand, FXAIX seeks to track the S&P 500 Index.

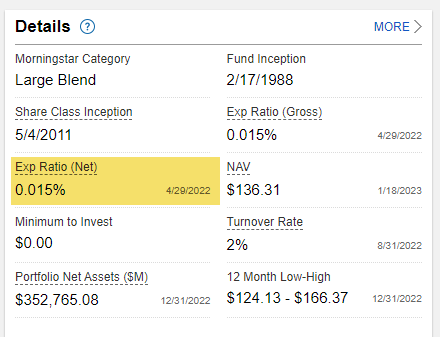

FSPGX vs FXAIX: Expense Ratio

One key difference between FXAIX and FSPGX is the expense ratio.

FXAIX has an expense ratio of 0.02%, while FSPGX has an expense ratio of 0.04%. Both funds charge relatively low yearly fees compared to those in the same category.

FSPGX vs FXAIX: Top 10 Holdings

Morningstar places both FSPGX and FXAIX in its Large Blend category, which means that these funds are likely to have many overlapping stocks in their portfolio.

Let’s take a look at their top holdings.

FXAIX Top 10 Holdings

| Name | Symbol | % Assets |

|---|---|---|

| Microsoft Corp | MSFT | 6.36% |

| Apple Inc | AAPL | 6.00% |

| Amazon Inc | AMZN | 3.75% |

| Tesla Inc | TSLA | 2.31% |

| Alphabet Inc Class A | GOOGL | 2.27% |

| Alphabet Inc Class C | GOOG | 2.13% |

| Meta Platforms Inc Class A | FB | 1.97% |

| NVIDIA Corp | NVDA | 1.63% |

| Berkshire Hathaway Inc Class B | BRK.B | 1.36% |

| JPMorgan Chase & Co | JPM | 1.30% |

FSPGX Top 10 Holdings

| Name | Symbol | % Assets |

|---|---|---|

| Microsoft Corp | MSFT | 10.75% |

| Apple Inc | AAPL | 10.11% |

| Amazon Inc | AMZN | 6.29% |

| Tesla Inc | TSLA | 3.82% |

| Meta Platforms Inc Class A | FB | 3.33% |

| Alphabet Inc Class A | GOOGL | 3.30% |

| Alphabet Inc Class C | GOOG | 3.08% |

| NVIDIA Corp | NVDA | 2.63% |

| The Home Depot Inc | HD | 1.70% |

| Visa Inc Class A | V | 1.54% |

FSPGX vs FXAIX: Dividend Yield

The dividend distribution schedule differs between FXAIX and FSPGX. The Fidelity 500 Index Fund pays quarterly dividends, whereas the Fidelity Growth Fund pays dividends semi-annually.

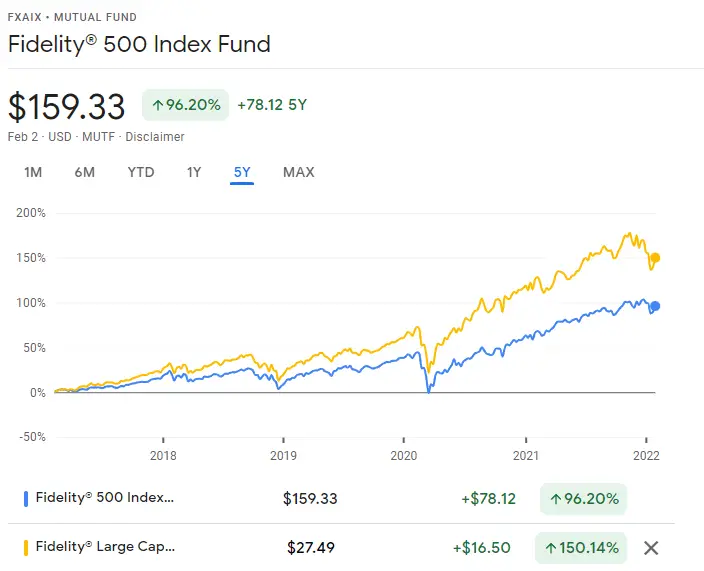

FSPGX vs FXAIX: Annual Return

In the last five years, the Fidelity Large Cap Growth Fund has predominantly outperformed the S&P 500 Index. This is due to the fact that FSPGX only includes growth stocks, whereas FXAIX includes both growth and value stocks.

| Funds | Fidelity® Large Cap Growth Index Fund | Fidelity® 500 Index Fund |

|---|---|---|

| 1 month | +2.10% | +4.48% |

| 3 months | +11.62% | +11.02% |

| 6 months | +12.91% | +11.66% |

| 1 year | +27.58% | +28.69% |

| 3 years | +34.04% | +26.06% |

| 5 years | +25.25% | +18.46% |

Which is Better, FSPGX or FXAIX?

The Fidelity 500 Index Fund (FXAIX) is a better investment than the Fidelity Large Cap Growth Index Fund (FSPGX).

FXAIX has a lower expense ratio, which means that you will pay less in fees for owning this fund. It also has a longer history of performance, making it a safer investment choice.

That is not to say FSPGX is a bad investment. If you still have a long time before retirement and are okay with full exposure to growth stocks, investing in FSPGX can be rewarding.

Personal Takeaways

1. When keeping your portfolio simple, one strategy to consider is to allocate 80% of your investments in the Fidelity Zero Total Market Index Fund (FZROX) and 20% in the Fidelity Large Cap Growth Fund (FSPGX). This way, you can continue to add to your investments over time without constantly reevaluating your portfolio until you retire.

2. FSPGX is a great option for growth-oriented investors because of its solid returns and low expense ratio. It serves as the Fidelity equivalent of Vanguard’s VWUSX fund.

3. Some investors may use FSPGX as a substitute for VWUSX, as it has provided better returns than the Fidelity 500 Index Fund. The Fidelity Mid Cap Growth Index Fund (FMDGX) has also been outperforming FXAIX. The holdings in these funds are similar, but FMDGX emphasizes mid-cap stocks more than large-cap stocks.

4. Some of you may choose to invest in FZROX due to its zero expense ratio. However, it’s worth noting that FSPGX has a better performance record.