While Fidelity is renowned for its extensive range of low-cost ETFs and mutual funds, some users may encounter challenges such as website usability issues, account restrictions, and the absence of instant deposit options.

In this guide, we’ll walk you through the process of closing and deleting your Fidelity account, should you decide it’s the right move for you.

Reasons to Consider Closing Your Fidelity Account

Difficulty Navigating the Website

Some users may find it challenging to navigate the Fidelity website, which can be a significant factor in their decision to explore other options.

Account Restrictions

Fidelity’s account restrictions may not align with your specific needs or preferences, and it’s okay to consider account closure.

Absence of Instant Deposits

The lack of instant deposit could be crucial for those wanting quicker access to funds for day trading purposes.

Consolidating Accounts

You’re streamlining your investments by consolidating multiple accounts into a single platform.

Before Your Account Deletion

Before you begin, ensure you’ve completed the following steps:

- Sell or Transfer Positions:

- If you have existing stocks in your Fidelity brokerage account, decide whether to sell them or transfer them to another brokerage.

- Withdraw Funds:

- Safely withdraw your funds from your Fidelity account back into your designated bank account.

How to Delete a Fidelity Account

Option #1: Automatic Account Closure

If you decide to sell all of your positions and withdraw the remaining balance to your bank account, you can conveniently close your Fidelity account directly on the website.

Step 1: Visit the Fidelity website and login.

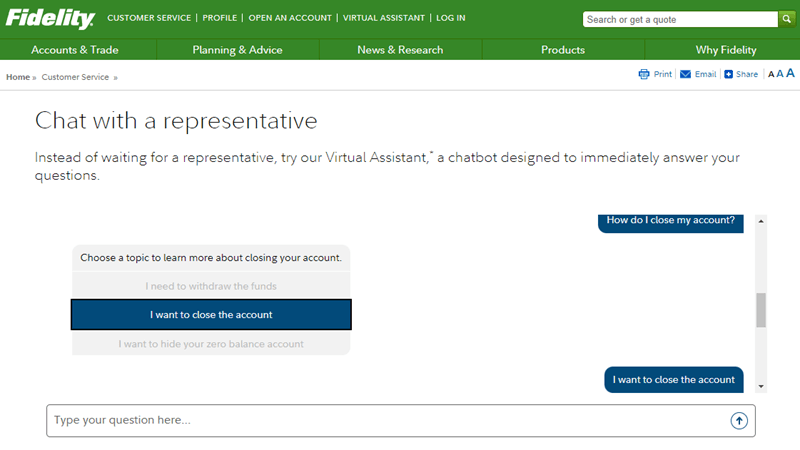

Step 2: Click on Fidelity’s Virtual Assistant.

Step 3: In the chat, type “close account.”

Step 4: Follow the on-screen instructions and confirm your account deletion.

Option #2: For customers with existing positions, account balance, restrictions, etc:

Step 1: Call Fidelity customer service (800-343-3548).

Step 2: Ask a customer representative to close your Fidelity account.

Note: If you prefer not to liquidate your current holdings, you may need to initiate an ACAT transfer to a new brokerage. They will move the existing positions and cash balance from your Fidelity account to the new brokerage account.

Closing Specific a Fidelity Account

To close one of your Fidelity accounts, you have to call Fidelity and let them know which one to cancel and they will close it for you.

Fidelity Cancellation Fee

Good new! Fidelity does not charge account closure fees.

While Fidelity offers many benefits, it’s essential to recognize that individual preferences and needs vary.

The steps above show how you can quickly close and delete your Fidelity accounts within minutes.