Someone asks:

I sold a stock at a loss, then repurchased it to average down, resulting in a Wash Sale violation in my Fidelity account. If I buy shares at a lower price and then sell the shares that incurred a loss, would that still be considered a Wash Sale violation?

Fidelity Wash Sale Explained

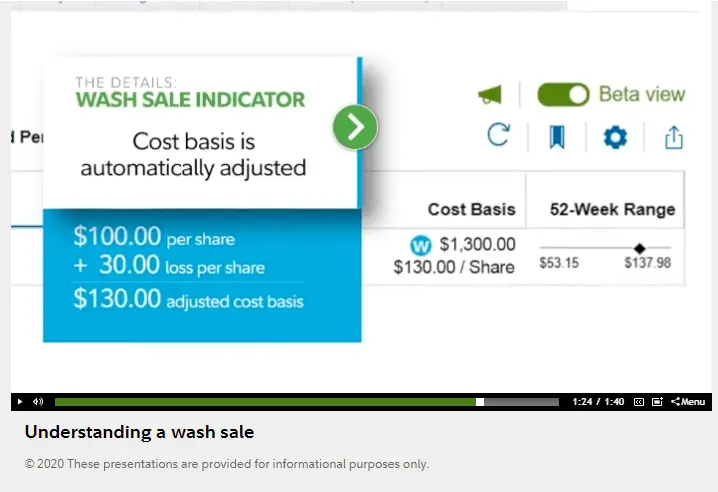

The Wash Sale rule aims to prevent individuals from selling securities at a loss solely to claim a tax advantage.

A wash sale occurs when a security is sold at a loss and re-purchased within 30 days. On Fidelity, it will show a note saying, ‘Adjusted due to previous Wash Sale disallowed loss.”

How To Avoid a Wash Sale on Fidelity

To avoid triggering a Wash Sale in your Fidelity account, ensure that you don’t repurchase the same stock within 30 days before or after the realized loss. This means you must wait 30 +1 days after the sale to buy again.

If you want to sell a losing position and keep the capital loss, you can always use the proceeds to buy a similar stock (or ETF) if you want to stay invested in the sector.

If dividends are set to be reinvested, even the smallest reinvestment will result in a wash sale, which will invalidate your losses.

Is It Possible To Remove a Wash Sale From Your Account?

It is not possible to eliminate a Wash Sale once it has been triggered in your account.

Do Wash Sale Rules Apply to Roth IRA?

A retirement account sale is never subject to wash sale. Normally, the terms “wash sale” and “retirement account” are never used in the same sentence.

There is no tax on traditional retirement accounts until distributions (no tax on Roth because you already paid tax at the start), so it makes no difference how much you make or lose on the account. The total amount of distribution is taxed.

Wash sale rule makes no difference at all on any IRA account.

💬 Community Discussion

Steven F:

I was initially worried when I first saw a flag for a Wash Sale. After researching, I understood that it primarily affects the tax-deductible losses you can claim, but it is not a violation in terms of trading.

Sandro C:

From personal experience, I had a Wash Sale violation and received 90-day trading restrictions. You are wise to focus on avoiding violations. Although Wash Sales are permissible, they do serve as a reminder of a loss taken.