Ever wonder how Fidelity calculates your account value along with the daily P/L (Profit/Loss) on each of the stocks in your portfolio?

In today’s article, let’s look into the intricacies of portfolio valuation and daily profit/loss (P/L) calculation on Fidelity.

What’s “Market Price”?

The market price or “Last Price” is just the current price of the stocks you have in your portfolio. It changes as the day goes on because the market is always moving.

So, if you own stocks, their prices will go up and down, and that affects how much your Fidelity portfolio is worth.

How Does Fidelity Calculate Today’s Gain/Loss?

You might see something called “Today’s Gain/Loss” on your Fidelity page. This number shows any money you put in or took out, plus any gains or losses from what you own.

If it shows a loss despite an apparent increase in the theoretical value of your securities, it might be because of low liquidity.

Consider a scenario where you own 5 different positions, and each of them experiences a gain of, say, $7 in a single day. If no other actions are taken on your account, your “Today’s Gain/Loss” should display an increase of the total gains, in this case, +$35.00.

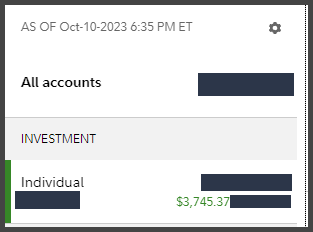

Fidelity Account Balances Calculation

You should know that Fidelity brokerage account balances are not static. They are updated regularly throughout each business day.

These values are responsive to market price fluctuations in the underlying securities within your Fidelity account. This dynamic nature means your portfolio’s value can change based on market conditions.

Additional Insights: Fidelity’s Footnotes

For more detailed information regarding your portfolio’s performance and calculations, I recommend exploring the Additional important information section in the footnotes of the Summary page.

This section can provide valuable insights into the specifics of your account’s balance.