SPY and SWPPX are both funds that track the S&P 500 index. They are very similar in terms of holdings and performance.

The main difference is that SPY is an ETF (exchange traded fund) and SWPPX is a mutual fund. This means that SPY can be bought and sold like a stock, while SWPPX can only be bought directly from the fund itself or pay an additional fee when purchase elsewhere.

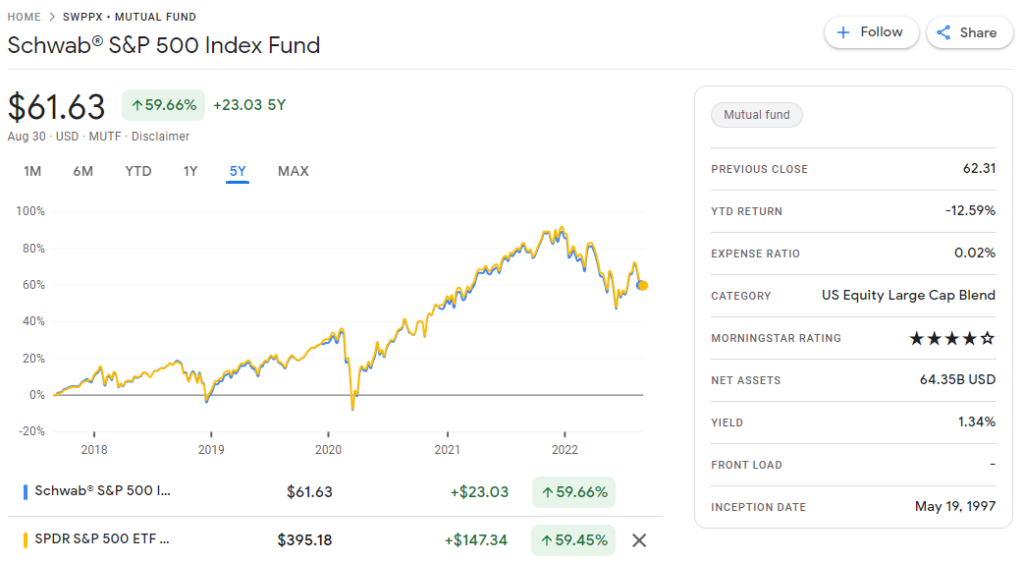

SWPPX: Schwab S&P 500 Index Fund

The Schwab S&P 500 Index Fund (SWPPX) is a mutual fund that tracks the performance of the S&P 500, an index of 500 large-cap U.S. stocks. The fund is managed by Charles Schwab Investment Management, which uses a passive indexing strategy to track the index.

SWPPX has a low expense ratio of 0.02%, which is lower than the average for similar funds. The fund is available to investors through Charles Schwab’s brokerage platform.

SPY: SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF Trust (SPY) is an exchange-traded fund (ETF) that tracks the S&P 500 Index.

The SPY is one of the largest and most popular ETFs in the world, with over $300 billion in assets under management.

The SPY is a passively managed index fund, meaning it seeks to track the performance of the underlying index (in this case, the S&P 500 Index) without actively trying to outperform it.

The fund is traded on the New York Stock Exchange and has an expense ratio of 0.09%.

SPY vs SWPPX: Key differences

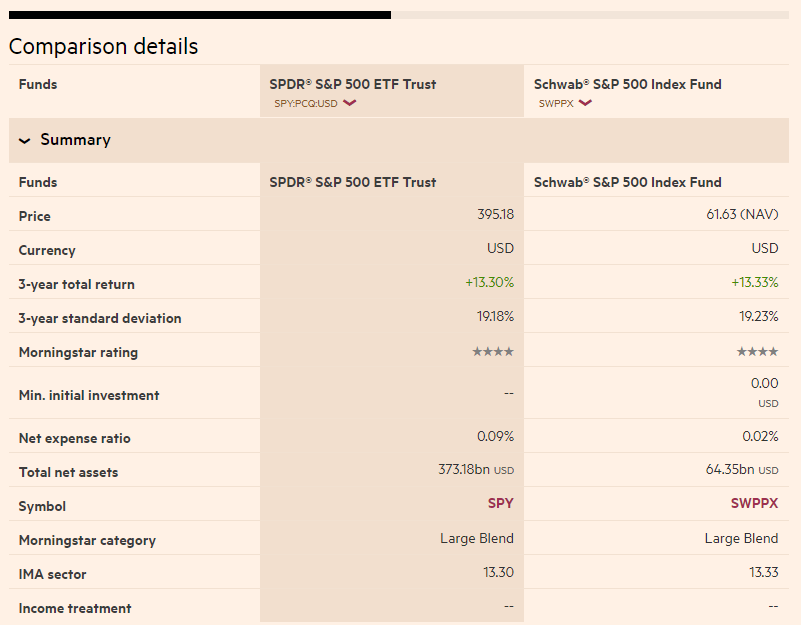

SPY is a much larger fund, with over $350 billion in assets under management compared to SWPPX’s $64 billion.

SPY has a slightly higher expense ratio than SWPPX, 0.09% compared to 0.02%.

You can trade SPY during market hours. With SWPPX, you can only buy or sell the fund at the end of the day.

SPY vs SWPPX: Which fund is better?

Winner: SPY

To the studious, casual observer the analysis presented here does NOT clearly explain the reason for considering SPY the better investment. If the cost of managing the respective funds, shown by the expense ratios, favors the Mutual Fund, what explains why SPY is the winner?