If you’re like me, you’ve probably wondered how to invest in the semiconductor industry.

You might also be wondering how two ETFs that are so similar differ from each other and if they can both be used effectively.

Below, we will compare SMH and SOXX to see which is better for your portfolio.

| Funds | VanEck Semiconductor ETF | iShares Semiconductor ETF |

|---|---|---|

| 3-year total return | +24.37% | +22.93% |

| 3-year standard deviation | 27.86% | 28.04% |

| Morningstar rating | 5/5 | 5/5 |

| Net expense ratio | 0.35% | 0.40% |

| Total net assets | 6.54bn USD | 6.32bn USD |

| Symbol | SMH | SOXX |

| Morningstar category | Technology | Technology |

SMH: VanEck Semiconductor ETF

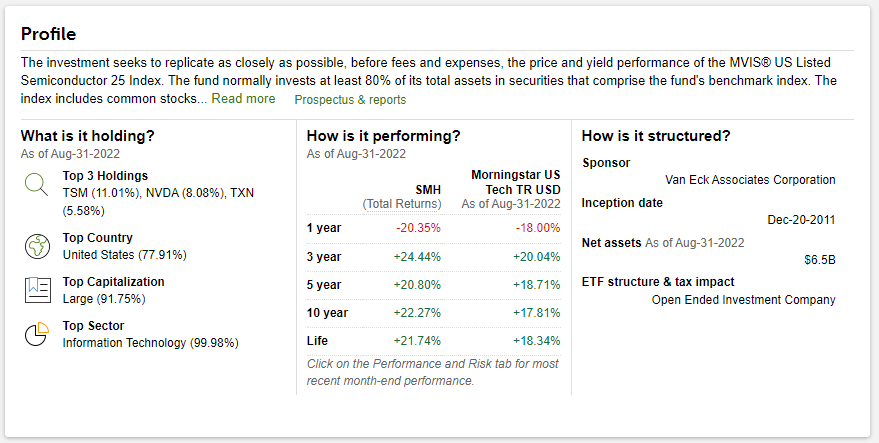

SMH is a US-based ETF that tracks the MVIS US Listed Semiconductor 25 Index, which includes some of the largest semiconductor stocks in the United States.

For those who want to invest in this sector but don’t have time or resources for research, SMH makes it easy by allowing you to buy into an already vetted portfolio of semiconductor stocks.

The top holdings in the SMH ETF are Taiwan Semiconductor Manufacturing (TSM), Intel (INTC), Broadcom (AVGO), Micron Technology (MU), and Applied Materials (AMAT).

SMH has a 0.35% expense ratio and is considered one of the cheapest ETFs with exposure to the semiconductor industry.

SOXX: iShares Semiconductor ETF

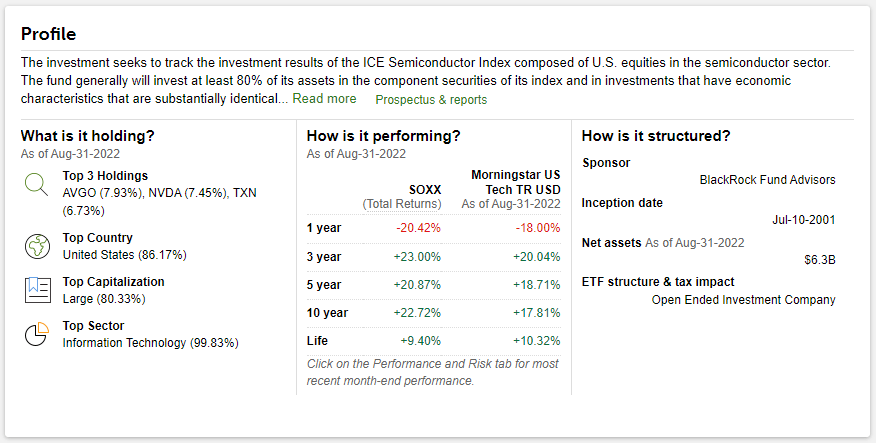

The iShares Semiconductor ETF (SOXX) is an exchange-traded fund (ETF) that tracks the performance of the ICE Semiconductor Index. The fund was launched in March 2001 and is managed by BlackRock.

The SOXX ETF is one of the largest and most liquid semiconductor ETFs with over $6 billion in assets under management. The fund has a relatively high expense ratio of 0.40% but offers exposure to a broad range of companies in the semiconductor industry.

SMH vs SOXX: Key differences

These two Semiconductor ETFs are very similar, from their top holdings to annual returns. However, there are still some key differences that you should be aware of.

The biggest difference is their expense ratios. SMH has a lower expense ratio than SOXX. This means it charges lower fees for investors than its competitor.

SMH also has a much higher average daily volume than SOXX: 4 million vs. 688 thousand per day. This makes SMH a great trading vehicle for day traders and long-term investors.

SMH vs SOXX: Which Semiconductor ETF Is Better?

In the end, you need to decide which of these ETFs is better for you.

We hope this article has helped you understand the differences between SMH and SOXX. If we had to choose one or the other, it would be SMH.

The fee on the VanEck Semiconductor ETF is lower. You get identical performance and an active liquidity pool if you want to trade your shares.