Are you curious about the Fidelity equivalent of the popular QQQ ETF, which mirrors the Nasdaq 100 index?

Look no further! In this guide, we’ll unravel the Fidelity Nasdaq Composite Index Fund (ONEQ), which is the equivalent of QQQ for Fidelity customers.

Let’s explore the similarities and differences between the two funds.

What Is QQQ?

QQQ is an exchange-traded fund that essentially follows the Nasdaq 100 index. It’s a “set-it-and-forget-it” type of fund designed to follow the market rather than attempt to outperform it.

QQQ primarily features heavyweight tech giants like Apple, Microsoft, Facebook, and Alphabet Inc.

Thanks to the booming technology sector and the substantial market caps of tech companies, QQQ has been a highly successful ETF.

Meet ONEQ – Fidelity Equivalent to QQQ

Now, let’s introduce you to the Fidelity alternative, the Fidelity Nasdaq Composite Index Fund (ONEQ).

Unlike QQQ, which focuses on the top 100 non-financial companies, ONEQ encompasses a staggering 1,000+ stocks listed on the Nasdaq exchange. This makes ONEQ more diversified than QQQ.

The Cost Factor

Launched in 2003, ONEQ boasts a reasonable expense ratio of 0.21%. Its low turnover rate of 11% indicates stability in its holdings.

QQQ edges slightly ahead in terms of expense ratio, sitting at 0.20%, compared to ONEQ’s 0.21%. The difference here is unnoticeable.

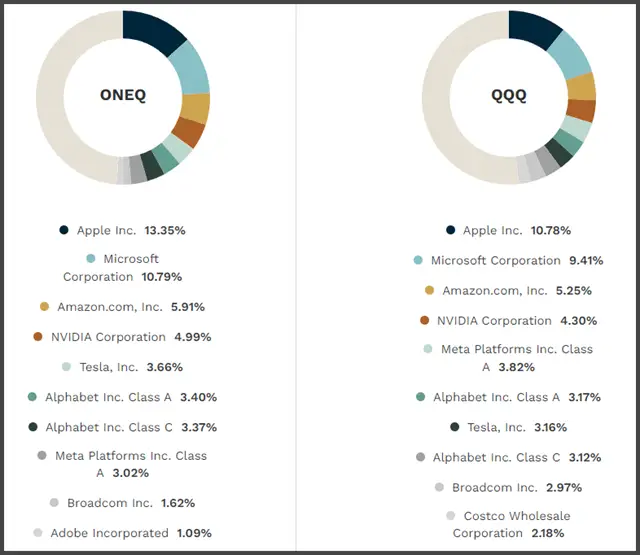

Portfolio Composition

QQQ’s portfolio is predominantly comprised of large-cap technology stocks. In contrast, ONEQ’s portfolio has over 1,000 different stocks on the Nasdaq exchange (including those in the QQQ).

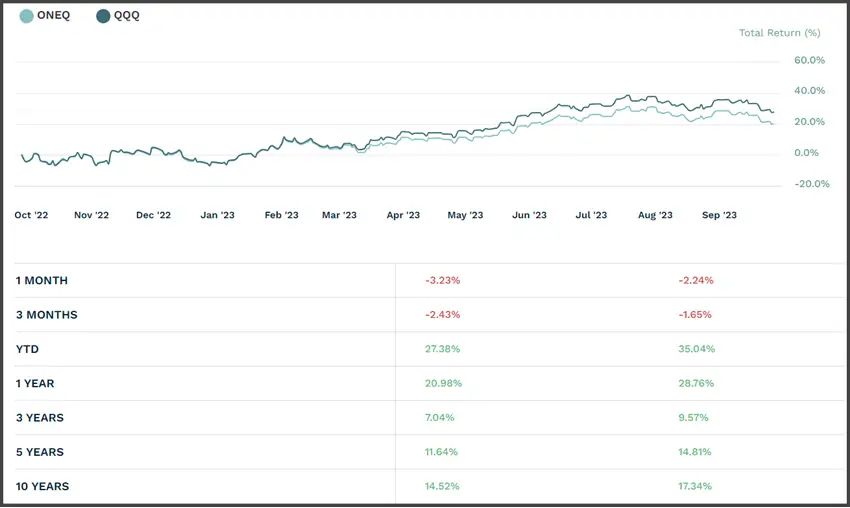

Comparing Performance

In the last 5 years, QQQ has demonstrated average annual returns of +14.82%, while ONEQ has shown +11.64%.

Both funds have received a top-notch Morningstar rating of 5/5 and fall under the “Large Growth” category.

Choosing Between QQQ and ONEQ

For those placing a premium on diversification, ONEQ may be the preferred choice. It contains a larger basket of stocks, though this could come at a slight sacrifice in growth potential.

If you’re comfortable with some risk and volatility, QQQ may offer higher returns.

Reader Insights

Our readers have shared additional nuggets of wisdom. Some recommend considering alternative ETFs like QQQM for a lower expense ratio and better performance in the long run.

In conclusion, when seeking the Fidelity equivalent of QQQ, look no further than ONEQ.