Do Fidelity investors have the opportunity to get TurboTax online for free for the 2024-2025 tax season? Follow this helpful guide to see if your account is eligible.

Here’s what you can do to check if your Fidelity account has received the exclusive offer, which allows them to file their taxes with TurboTax online at no cost:

In this tutorial, we will cover:

James S:

Fidelity is fantastic! I have a tip for anyone completing their taxes with TurboTax! On the summary page for my portfolio investments, I scrolled down to the bottom and discovered a link for TurboTax that stated I could do my taxes at no cost! I had already planned to use TurboTax, but now I can do so without any additional cost. I am extremely pleased with this.

Fidelity gave me the opportunity to complete my taxes with TurboTax at no cost! I had planned on using TurboTax regardless, but the added benefit of getting the Premier version for free was a fantastic bonus.

James S:

Fidelity is fantastic! I have a tip for anyone completing their taxes with TurboTax! On the summary page for my portfolio investments, I scrolled down to the bottom and discovered a link for TurboTax that stated I could do my taxes at no cost! I had already planned to use TurboTax, but now I can do so without any additional cost. I am extremely pleased with this.

Upon logging into my account, I received a notification that I was eligible for the free TurboTax Premier version. My Fidelity financial advisor was unable to provide an answer to my queries. Therefore, I purchased the TurboTax CD at Costco at a reduced price and used my usual method to prepare my taxes.

Cara B:

Fidelity gave me the opportunity to complete my taxes with TurboTax at no cost! I had planned on using TurboTax regardless, but the added benefit of getting the Premier version for free was a fantastic bonus.

James S:

Fidelity is fantastic! I have a tip for anyone completing their taxes with TurboTax! On the summary page for my portfolio investments, I scrolled down to the bottom and discovered a link for TurboTax that stated I could do my taxes at no cost! I had already planned to use TurboTax, but now I can do so without any additional cost. I am extremely pleased with this.

Fidelity needs to provide more helpful information regarding the free version of TurboTax for its clients.

Upon logging into my account, I received a notification that I was eligible for the free TurboTax Premier version. My Fidelity financial advisor was unable to provide an answer to my queries. Therefore, I purchased the TurboTax CD at Costco at a reduced price and used my usual method to prepare my taxes.

Cara B:

Fidelity gave me the opportunity to complete my taxes with TurboTax at no cost! I had planned on using TurboTax regardless, but the added benefit of getting the Premier version for free was a fantastic bonus.

James S:

Fidelity is fantastic! I have a tip for anyone completing their taxes with TurboTax! On the summary page for my portfolio investments, I scrolled down to the bottom and discovered a link for TurboTax that stated I could do my taxes at no cost! I had already planned to use TurboTax, but now I can do so without any additional cost. I am extremely pleased with this.

Seems kinda pointless to me – most millionaires are going to need a CPA, not an off-the-shelf product. Why not give it to the ones who’d actually use it?

William H:

Fidelity needs to provide more helpful information regarding the free version of TurboTax for its clients.

Upon logging into my account, I received a notification that I was eligible for the free TurboTax Premier version. My Fidelity financial advisor was unable to provide an answer to my queries. Therefore, I purchased the TurboTax CD at Costco at a reduced price and used my usual method to prepare my taxes.

Cara B:

Fidelity gave me the opportunity to complete my taxes with TurboTax at no cost! I had planned on using TurboTax regardless, but the added benefit of getting the Premier version for free was a fantastic bonus.

James S:

Fidelity is fantastic! I have a tip for anyone completing their taxes with TurboTax! On the summary page for my portfolio investments, I scrolled down to the bottom and discovered a link for TurboTax that stated I could do my taxes at no cost! I had already planned to use TurboTax, but now I can do so without any additional cost. I am extremely pleased with this.

Seems kinda pointless to me – most millionaires are going to need a CPA, not an off-the-shelf product. Why not give it to the ones who’d actually use it?

William H:

Fidelity needs to provide more helpful information regarding the free version of TurboTax for its clients.

Upon logging into my account, I received a notification that I was eligible for the free TurboTax Premier version. My Fidelity financial advisor was unable to provide an answer to my queries. Therefore, I purchased the TurboTax CD at Costco at a reduced price and used my usual method to prepare my taxes.

Cara B:

Fidelity gave me the opportunity to complete my taxes with TurboTax at no cost! I had planned on using TurboTax regardless, but the added benefit of getting the Premier version for free was a fantastic bonus.

James S:

Fidelity is fantastic! I have a tip for anyone completing their taxes with TurboTax! On the summary page for my portfolio investments, I scrolled down to the bottom and discovered a link for TurboTax that stated I could do my taxes at no cost! I had already planned to use TurboTax, but now I can do so without any additional cost. I am extremely pleased with this.

- The TurboTax Online Premium (Federal & State Returns) Offer

- How to check if your Fidelity account is eligible for TurboTax

- How to claim your free offer (or $5 download)

Free Fidelity TurboTax Premier or Online Offer

If your account is eligible, Fidelity provides selected customers with free access to TurboTax Free Online Premium, or $5 download for TurboTax Premier Desktop Edition for Federal and State returns (Additional state returns may incur extra costs).

Offer Eligibility Requirements

The free fidelity TurboTax Premium (or Online) deal isn’t explicitly outlined on its website and selection process appears inconsistent. In a January 7, 2025 Reddit post to r/fidelityinvestments the forum mod posted:

Free TurboTax offers are typically extended to our eligible customers each year beginning in mid-December and will display on the “Portfolio Summary” page when logging into Fidelity.com. The offer is for TurboTax Free Online Premium or Premier desktop download version ($5 for the download version). Please note that this offer applies to federal returns and one state return only. The cost of additional state returns, if necessary, would be your responsibility.

In addition, eligibility requirements are subject to change from year to year, so although you may have had the opportunity to utilize this offer in the past, it does not guarantee that you are still eligible for it or will receive it again.

Historically, Fidelity has offered free (or discounted) access to TurboTax for selected customers, however, eligibility appears to vary based on undisclosed criteria.

The following requirements are supported by online forum posts and personal experiences and believed to be a good indicator:

- Customers of Fidelity Wealth Management with $250,000+

- Customers of Fidelity Private Wealth Management with accounts in excess of < $1m in assets excluding 401(k)

- Accounts with multiple Fidelity products, including retirement, non-retirement, CMA, credit/debit card, and HSA accounts.

It’s important to note, that customers with smaller accounts have reported receiving the offer, while others with larger accounts (in excess of $1M+) have not received the offer.

How to Check Your Fidelity Account for Eligibility

The easiest way to check if your account is eligible for the free TurboTax download is by checking the Account Summary page in your Fidelity account. To check if you qualify for the free TurboTax offer:

Step 1: Log in to your Fidelity account. Use a web browser, not your Fidelity mobile app.

Step 2: Once logged in, navigate to the Summary tab for All Accounts.

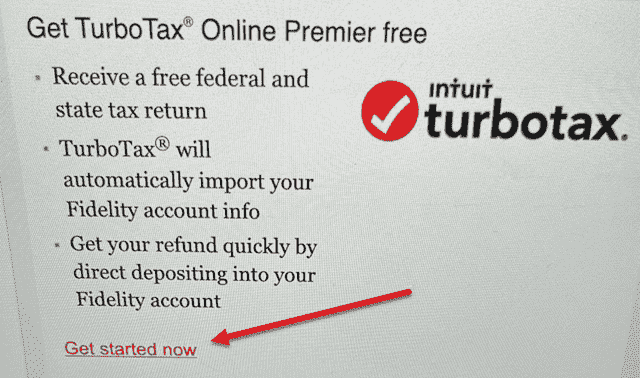

Step 3: Scroll down to the bottom of the page. If your Fidelity account is eligible for the free TurboTax software, you’ll see a text that says, “Get TurboTax Online Premier free.”

Step 4: Click on Get started now to redeem your offer.

If your account is eligible, you will receive the Fidelity’s free TurboTax offer notification in your account settings sometime between late-December and mid-January 2025.

If the TurboTax Premier offer is not available in your account summary, you are most likely not eligible. At the same time, some users reported their free offer didn’t show up until January. Be patient if it’s not visible immediately, as most brokerages aren’t even making 1099 forms available until late January to early February.

Remember: This offer is exclusively available to “select Fidelity customers”. Fidelity customers who do not meet the requirement can still get 25% off TurboTax Online and TurboTax Live.

Reported Problems and Solutions

Trouble finding the offer: Some couldn’t locate the free TurboTax option. Suggestions included:

- Enabling “beta view” in the Fidelity account settings.

- Contacting Fidelity’s customer service for assistance.

Preference for desktop version: Finding the desktop TurboTax version was challenging. Solutions offered:

- Accessing the TurboTax download link directly via this link.

- Searching for the desktop product by using the “help” feature on the site.

How to Get Discounted TurboTax if You’re Not Eligible

If you’re not eligible for the the Fidelity offer, UseFidelity found deals at Amazon for TurboTax Deluxe 2024 starting at $55.99 (30% off) for PC/Mac digital downloads.

Updated: January 7, 2025

- TurboTax Deluxe 2024 (Federal & State Returns): $55.99 [$77.99 30% off limited-time] PC/Mac Download: Recommended if you own a home, have charitable donations, high medical expenses.

- TurboTax Premier 2024 (Federal & State Returns): $82.99 [$114.99 28% off limited-time] PC/Mac Download: Recommended if you sold stock, bonds or mutual funds, sold employee stock, own rental property or are a trust beneficiary.

- TurboTax Home & Business 2024 (Federal & State Returns): $95.99 [$129.99 26% off limited-time] PC/Mac Download: Recommended if you are self-employed, an independent contractor, freelancer, small business owner, sole proprietor, or consultant

- TurboTax Business 2024 (Federal & State Returns): $143.99 [$189.99 24% off limited-time] PC/Mac Download: Recommended if you have a partnership, own an S or C Corp, Multi-Member LLC, manage a trust or estate, or need to file a separate tax return for your business.

Remember: Fidelity customers who do not meet the requirement can still get 25% off TurboTax Online and TurboTax Live.

(Or, if you’d like to support our site, please consider 20% off TurboTax Online ($0 – 72 per filing) or TurboTax Live Full Service ($72 per filing) affiliate offer.

Final Thoughts

While Fidelity’s offer is enticing, not all Fidelity customers qualify. In fact, most aren’t eligible.

💬 Community Discussion

Pete D:

Seems kinda pointless to me – most millionaires are going to need a CPA, not an off-the-shelf product. Why not give it to the ones who’d actually use it?

William H:

Fidelity needs to provide more helpful information regarding the free version of TurboTax for its clients.

Upon logging into my account, I received a notification that I was eligible for the free TurboTax Premier version. My Fidelity financial advisor was unable to provide an answer to my queries. Therefore, I purchased the TurboTax CD at Costco at a reduced price and used my usual method to prepare my taxes.

Cara B:

Fidelity gave me the opportunity to complete my taxes with TurboTax at no cost! I had planned on using TurboTax regardless, but the added benefit of getting the Premier version for free was a fantastic bonus.

James S:

Fidelity is fantastic! I have a tip for anyone completing their taxes with TurboTax! On the summary page for my portfolio investments, I scrolled down to the bottom and discovered a link for TurboTax that stated I could do my taxes at no cost! I had already planned to use TurboTax, but now I can do so without any additional cost. I am extremely pleased with this.

Hello, based on the article above I meet both requirements. I am listed as a Premium Services customer on their summary page. I do not have the free turbo tax listed on the summary page but when I use the search box for “Free turbo tax” it takes me to the $20 off offer and not the free offer. Any advice is appreciated.

You should call Fidelity customer service at 800-343-3548. If you are a Premium Services customer, the offer should be visible within your account.

Thank you Diego for your response. Looks like I am one of the unlucky clients this tax season. I contacted Fidelity and here is their response.

“Thank you for contacting us regarding free TurboTax Premier online. We appreciate you taking the time to contact us through secure message, and I am happy to offer my assistance.

Each year we have a certain number of free TurboTax offers that we are able to extend to our customers. I regret to inform you we were unable to offer it to you this year. We value your business and certainly apologize for any inconvenience this may cause. The good news is that we are able to offer you up to $20 off of TurboTax online. You can locate a link to this offer through your “Accounts & Trade” tab under “Tax Forms & Information.” “

You’re welcome, Clive!

I appreciate you sharing the response you received from Fidelity, and I’m glad to hear that they were able to offer you a discount on TurboTax online.

Hi, Set up turbotax account for premier version very quickly via the Fidelity link upon login.

If I fill in the info on the online questions, but answers change, ie cost basis has to be adjusted, incorrect data entered but caught in time, etc. does program allow multiple changes before submitting return?

Will turboTax charge me once I submit the return?

Thanks,

gr

I did not find this article very helpful because it omits a crucial fact that my Private Client advisor provided when I told him that I could not access the “free” TurboTax offer. YOU MUST SELECT THE BETA VIEW on your Portfolio Summary page. Once I did this, the process was easy because that view displays the panel with a link to the TurboTax offer. For the record, if you elect to download TurboTax instead of using the online version, TurboTax Premier costs $5. Only the online version is truly free.

Can you upgrade this with cash to home & business? Also, can you let someone else use your turbo tax, provided they have access to your fidelity account?

Thanks!

If you use the download version, you can upgrade to Home & Business for $15 after you install the product. It was $10 in previous years. If you use the online version, I don’t think you can get the better version just by paying the difference. Go to Help -> Upgrade TurboTax.