As you embark on your investing journey, you may wonder if having multiple accounts on Fidelity.com is possible. The good news is, yes, it’s possible to have multiple account with a single login.

This article will guide you through the process and shed light on the benefits of this approach.

The Benefits of Having Multiple Fidelity Accounts

1. The Power of One Login

Did you know you can have all your Fidelity accounts in one login? That means you don’t need to create multiple usernames or passwords just to manage each investment account.

2. Segregate for Clarity

Consider opening multiple Fidelity accounts to keep your work-related investments, like your 401k, separate from your personal brokerage account.

As one Reddit user noted, “Your company couldn’t see your personal stuff.” You can enjoy the benefits of Fidelity’s platform for both your professional and personal financial goals without any overlap.

3. Personalized Financial Strategy

You may find that having distinct accounts on Fidelity helps with your trading and money management strategies. For example, one account can be used for day trading while the other is kept for swing trading and long-term investing.

Also, whether you’re considering an ETF-only portfolio or mixing in individual stocks, having multiple Fidelity accounts allows you to monitor the performance of each investment style independently.

One Account or Multiple?

There aren’t any general downsides to having multiple Fidelity accounts. Ultimately, the choice between consolidating accounts or keeping them separate comes down to personal preference.

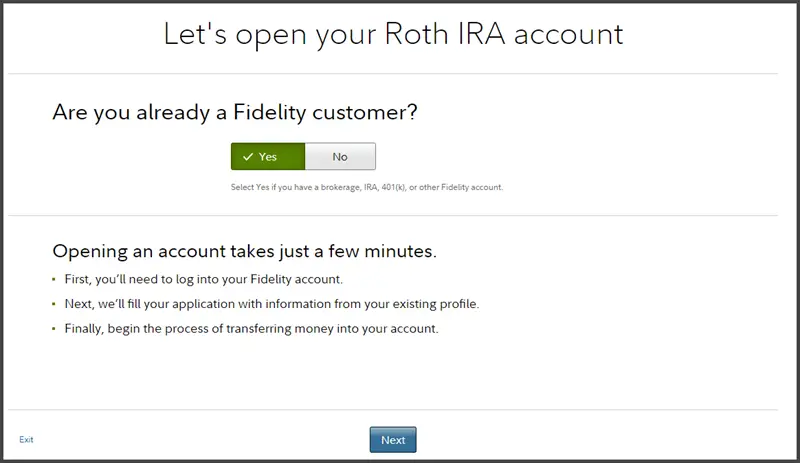

To initiate the process of opening an additional brokerage account with Fidelity, follow these steps:

- Begin by visiting the Fidelity website.

- Locate and click on the “Open an Account” option.

- Select the type of account you wish to open.

- Click Yes on “Are you already a Fidelity customer?”

- Log in to your current Fidelity account.

- Complete the application to open your new account.

💬 Community Discussion

Mike R:

I’ve gone in the complete opposite direction. I do have multiple accounts with Fidelity (and others), but 401k aside, I manage allocations in all my accounts as if it’s one portfolio.

Jason B:

I have 3 accounts opened with Fidelity. I do pay debts from the cash/brokerage account so that has been different for me than a regular checking account. and I’m thinking of making the 2nd brokerage more of a trading account with just individual stocks.

John M:

I actually have 5.

1. My primary cash account for direct deposit, bill pay etc.

2. Investment.(taxable) Heavy munis essentially 75% of all my bonds in my portfolio. Even split with BRK/B in acct

3. 401k balanced account.

4. Roth equal sector dividend growth focus.

5. Real estate. Property investment account including rental payments.