I recently had a trading experience with Fidelity that led me down a rabbit hole of curiosity about “Total Price Improvement.”

You may have seen this figure on some of your trades or transactions.

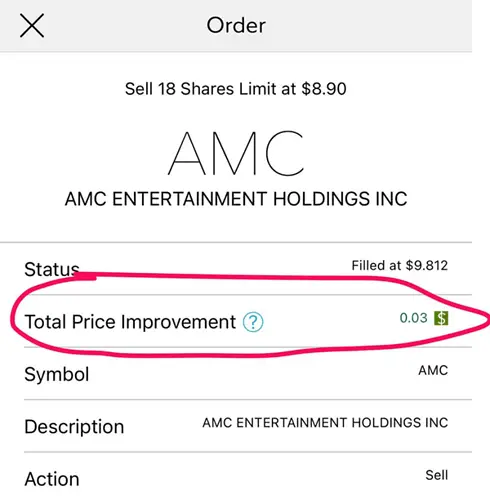

The Scenario: I decided to sell my AMC shares today. To my surprise, Fidelity reported a Total Price Improvement of $0.03 on the trade. At first, I was thinking: how did this come about?

Allow me to break it down based on my own experience and understanding.

Fidelity Total Price Improvement: How It Works

Fidelity’s Price Improvement isn’t just a catchy term; it’s a genuine benefit they offer their clients.

When I placed my limit order to sell AMC at $8.90, I set a threshold, stating that I wouldn’t accept anything less. But here’s where Fidelity’s expertise comes into play.

Unlike platforms that capitalize on order flow, Fidelity is committed to securing the best possible price for your orders. In my case, they managed to execute at a higher price, resulting in the reported price improvement of $0.03.

Realizing the Impact

This experience made me realize that Fidelity’s focus isn’t merely on facilitating trades; it’s about making those trades as advantageous as possible for their clients.

You might wonder, does a $0.03 improvement really make a difference? Absolutely. While it might seem modest on a single trade, when multiplied across numerous transactions, it can add up significantly.

So, the next time you execute a trade in your Fidelity brokerage account, you may see this Total Price Improvement number on your trade confirmation page. This just means Fidelity was able to secure a better price for you to buy or sell.