Someone asks:

Lately, VFIAX seems quite up compared to VTSAX. I recently read this article which gave me more info but hasn’t helped me understand what course I should take in the future.

The article implies that one would want to choose either VTSAX or VFIAX as an “investment strategy.” But is that right? Should I choose one or the other, or would it be wise to hold both?

VTSAX vs. VFIAX: How Do They Compare?

In this article, let’s take a look at the differences and similarities between VTSAX and VFIAX.

Underlying benchmark

VTSAX is a total stock market fund that aims to provide broad market exposure by tracking the CRSP US Total Market Index. This index includes nearly every publicly traded company in the U.S.

Conversely, VFIAX is a fund that tracks the S&P 500 Index, which includes the top 500 publicly traded companies in the United States.

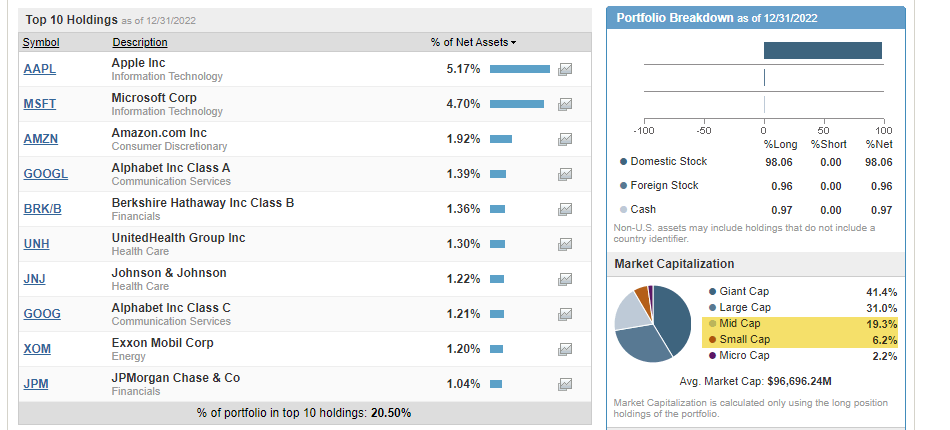

Market capitalization

One key difference between the two funds is that VTSAX has a higher percentage of mid and small-cap stocks compared to VFIAX.

While VTSAX is made up of 19% mid-cap stocks and 6% small-cap stocks, VFIAX is focused only on large-cap stocks.

Historically, small caps have outperformed large caps in the long run, so VTSAX may be a better choice for those looking for more diversification.

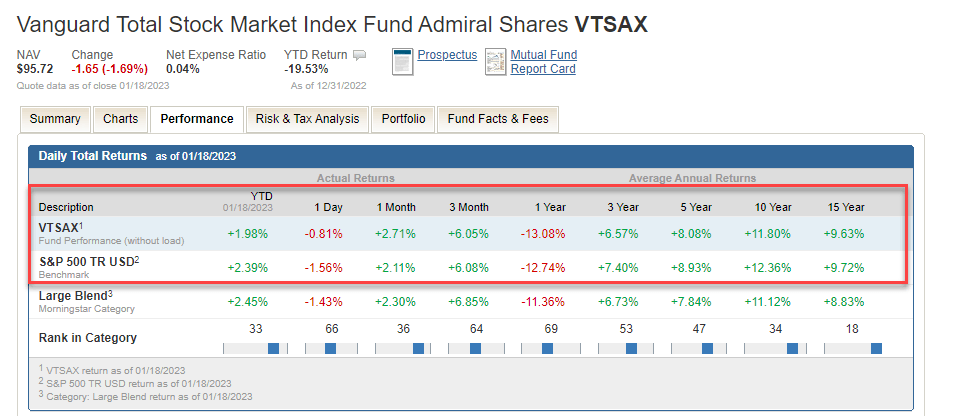

Fund performance

VTSAX is considered an all-in-one solution, as it covers the whole market. However, it is cap-weighted which means the proportion of the tail end companies is pretty small, which is why returns are so similar to the S&P 500 fund.

Some investors may choose to hold both VTSAX and VFIAX for more diversification.

Over the last 5 years, the performance of both funds has been similar, but VTSAX has done slightly better since its inception, while VFIAX has done slightly better over the last 10 years.

Expense ratio

The good news is that VFIAX and VTSAX both have similar fees, with an expense ratio of 0.04%.

VTSAX vs. VFIAX: Which Is Better?

VTSAX and VFIAX are solid choices for index fund investors.

VTSAX provides broad market exposure and includes some mid and small-cap stocks in its portfolio, whereas VFIAX is concentrated on large-cap stocks.

If I had to pick one, it would be VTSAX. There is nothing wrong with a bit more diversification.

What’s the Fidelity Equivalent of VTSAX?

FSKAX is the Fidelity equivalent of VTSAX. It tracks the Total Stock Market Index and has cheaper fees than the Vanguard’s Total Stock Market Fund.

What’s the Fidelity Equivalent of VFIAX?

FXAIX is the Fidelity equivalent of VFIAX. The fund tracks the S&P 500 Index and has a comparable expense ratio.