Are you overwhelmed by the world of investing? Maybe you just want a service that can take the guesswork out of building your portfolio. If that is the case, Fidelity may have the answer with Fidelity Go.

This post will give you an overview of the services provided by Fidelity Go, including its primary features, fees, and whether it’s worth a try.

What is Fidelity Go?

Fidelity Go is a new, low-cost robo advisor from Fidelity Investments. It offers a simple way to invest in mutual funds with no minimum account balance or annual fee.

Fidelity Go puts your money into a diversified mix of investments, automatically rebalances your portfolio, and reinvests your dividends so you can grow your money over time.

The best part? You can open an account with as little as $10.

How much does Fidelity Go cost?

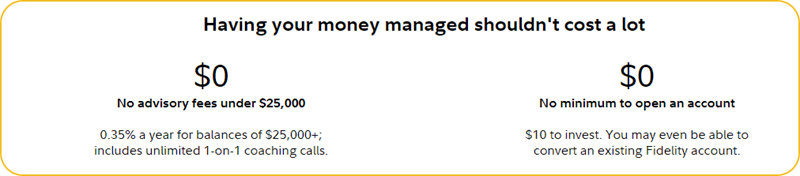

Fidelity robo advisor has a very straightforward fee structure:

- No advisory fees for an account with a balance under $25,000.

- 0.35% per year for account with a balance of $25,000+. Fidelity Go also gives you unlimited 1-on-1 coaching calls with a human advisor.

What type of investments can I expect from Fidelity Go?

It’s important to note that with Fidelity Go, you won’t be able to buy and sell individual stocks. Instead, the trading is done by Strategic Advisers LLC.

But don’t worry, your Fidelity Go account will still hold a mix of stocks through Fidelity zero expense ratio funds, also known as Fidelity Flex mutual funds.

Is Fidelity Go Worth It?

When it comes to robo advisors, there are a lot of them to choose from.

So, is Fidelity Go worth it?

That depends on your needs and preferences. They offer a wide variety of features. For example, they have no account minimums, which is great for anyone just starting out. They also provide a diverse range of investment options, such as stocks and bonds.

I think if you are looking for a low-cost investment option and are comfortable with letting a computer manage your portfolio, then Fidelity Go Robo Advisor may be a good fit for you.

What people are saying about Fidelity Go

Arkady F:

I’ve been using Fidelity Go since August 2020 for both my traditional IRA and Roth IRA and I’m really happy with it!

They’ve been doing a great job diversifying my IRAs among different types of funds like S&P 500 index funds, international stock index funds, bonds, mid-cap, and small-cap index funds. So far, no complaints.

Evan W:

I’ll be honest, researching and making investment decisions takes time and effort. So if you don’t have time for that, Fidelity Go is still a great option. It’s perfect for those who want to be more hands-off with their investments.

Ali S:

I’ve been using Fidelity for a while now, and I have to say, their research platform is great! If you have time, I highly recommend doing your own research on how you want to build your portfolio and taking control of it. Robo-advisors like Fidelity Go can be helpful, but the truth is, it’s pretty easy to do it yourself.

I did open a robo-advisory account with Wealthfront for my taxable investments, but I also opened a Roth IRA with Fidelity. I’ve been researching and building my portfolio, and I’m thinking about transferring my taxable account to Fidelity next so I can take more control of it. To be honest, I didn’t feel like paying the fees for the robo-advisory service was worth it.

Kyle G:

I’m not a big fan of robo-advisors that simply buy ETFs for you because you can do that yourself.

With Fidelity Go, you can use the service for free for only up to $10k. After that, you can just buy the ETFs yourself and save the fee.

It’s easy to invest in ETFs on your own, and it can be a way to save money in the long run.

Pat G:

I’m currently giving Fidelity Go a try. I deposited some money into it and set my aggression scale. It was smooth to get started. Now, I’m just waiting to see how it performs.

Ace A:

I’ve recently started using Fidelity Go. It’s free until my portfolio reaches $10k. I don’t know much about investing, but I wanted to get my foot in the door and start learning.