Before building a portfolio based on Dave Ramsey’s investing strategy, you must decide which mutual funds to include.

Assuming you have an account with Fidelity Investments, we have that list handy.

Dave recommends spreading your investments evenly among the four categories listed below:

- Growth (25%)

- Growth and Income (25%)

- Aggressive Growth (25%)

- International (25%)

Fidelity has a large selection of mutual funds that meet Dave Ramsey’s 4 mutual fund types.

Let’s take a closer look at each fund.

Fidelity Blue Chip Growth Fund (FBGRX)

FBGRX is a growth mutual fund from Fidelity. It invests at least 80% in blue chip companies.

- Expense ratio: 0.79%

- Morningstar category: Large Blend

- Minimum to Invest: $0.00

- Dividend distribution: September, December

- Similar Large-cap funds: FXAIX, FCNTX, FZROX, FSKAX, FNILX

Fidelity Extended Market Index Fund (FSMAX)

Fidelity’s FSMAX mutual fund seeks to provide investment results that track the total return of mid- to small-cap US companies.

- Expense ratio: 0.035%

- Morningstar category: Mid-Cap Growth

- Minimum to Invest: $0.00

- Dividend distribution: April and December

Fidelity Small Cap Index Fund (FSSNX)

Fidelity’s FSSNX is a small-cap mutual fund that invests 80% of its assets in stocks from the Russell 2000 Index.

- Expense ratio: 0.025%

- Morningstar category: Small Blend

- Minimum to Invest: $0.00

- Dividend distribution: June and December

- Similar Small-cap funds: FCPGX and VISGX

Fidelity ZERO International Index Fund (FZILX)

FZILX is a no-fee fund from Fidelity with a focus on international companies. It tracks the total return of foreign developed and emerging stock markets.

- Expense ratio: 0.00%

- Morningstar category: Foreign Large Blend

- Minimum to Invest: $0.00

- Dividend distribution: December

- Top 10 holdings: Taiwan Semiconductor, Nestle, Tencent, Samsung Electronics, ASML, Roche Holdings, Toyota Motor, LVMH, Alibaba, and Novartis.

- Similar International funds: FSPSX and FEMKX.

Dave Ramsey Fidelity Mutual Funds Backtesting Results

I conducted some backtesting using three Fidelity funds with long track records of success, and I would like to share the results.

However, I am not suggesting this is a good idea to implement.

Nevertheless, the backtesting shows two things.

1. Patient investors tend to be rewarded over long periods of time.

2. As Dave has repeatedly said, it is advisable to stick to funds that have been around for 20+ years and have an established track record of success.

The results I am sharing are from 1988 to the present, but I will also discuss different time periods.

FLPSX

The first fund I tested was FLPSX, which I made the core holding.

FLPSX is surprisingly well-diversified across market caps and has a domestic/international split of roughly 60%/40% (excluding the cash it keeps on hand).

I was curious to see if FLPSX could serve as a core holding, despite the fact that it is never used that way.

FOCPX and FBGRX

To complement the core holding of FLPSX, I used FOCPX and FBGRX separately.

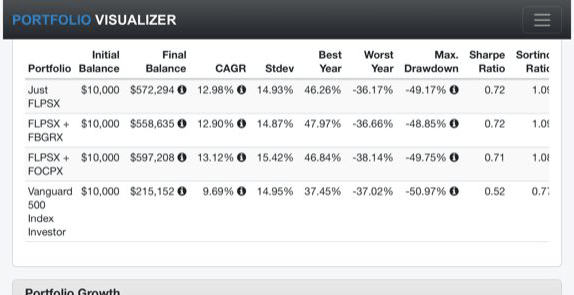

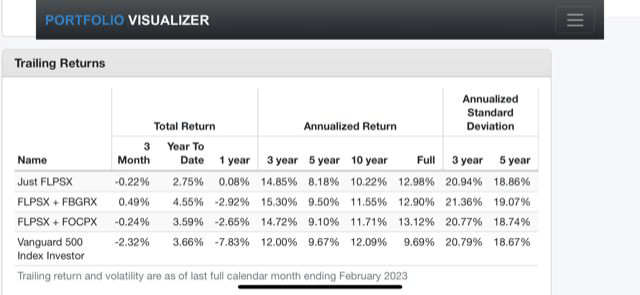

As shown in the screenshots, if you had held any of my three tested combinations from 1988 to the present, you would have outperformed the S&P 500 in both absolute and risk-adjusted returns.

However, testing different periods reveals a caveat. Rather than posting multiple photos, I will summarize the results for other time periods.

From 1988 to the present, all three combinations tested more than doubled the absolute returns of the S&P 500, with a significantly higher Sharpe ratio.

From 1995 to the present, there were still considerably higher absolute returns, with a considerably higher Sharpe ratio.

From 2000 to the present, there were still over double the absolute returns of the S&P 500, with a much higher Sharpe ratio.

However, from 2005 to the present, the gap narrowed considerably. All three combinations narrowly beat the S&P 500, and two of the combinations had slightly higher Sharpe ratios.

From 2010 to the present, the tables turned, and the S&P 500 had a narrow edge in absolute returns with a slightly higher Sharpe ratio.

From 2015 to the present, the S&P 500 had narrowly better absolute and risk-adjusted returns.

Finally, from 2020 to the present, the tables turned again, and all three fund combinations narrowly beat the S&P 500 in absolute returns with a decently higher Sharpe ratio.

While backtesting has limitations, testing the three combinations over different periods was fascinating.

💬 How Are You Building Your Portfolio?

Tyler W:

Fidelity is great at waving loads and transaction fees. I use Fidelity and am currently in FSCSX, MACGX, QUASX, and MIOPX. Fidelity waived the fees on all of them, and I’m considering switching to CPOAX, which they also waive the fees on.

Daniel S:

FOCPX is solid. That’s probably the best one I use that aligns with Dave 100%. They have good index funds, but many of their top performers are sector funds, and Dave doesn’t recommend those.

Aaron M:

Just so that you’re aware of it, you can buy Vanguard ETFs commission-free on the Fidelity platform. You can also buy the Vanguard mutual funds for a transaction fee ($75 per trade). I tend to prefer the Vanguard funds over Fidelity funds.

The following allocation will more or less correspond to Dave’s categories, with 25% in each:

- VOO (Vanguard S&P 500 ETF)

- VO (Vanguard Mid Cap ETF)

- VB (Vanguard Small-Cap ETF)

- VXUS (Vanguard Ex-US International ETF)

Each of those also has mutual fund equivalents if you prefer to steer clear of ETFs (as Dave tends to advise).

Coke S:

For me, I’m 29 years old, so it varies. I do 40% large-cap 30%, mid-cap 20%, small-cap 10% international. This would be considered very aggressive.

Mike L:

My portfolio:

- Growth & Income: FXAIX

- Growth: FSMDX

- Aggressive Growth: FSSNX

- International: FTIHX