Someone asks:

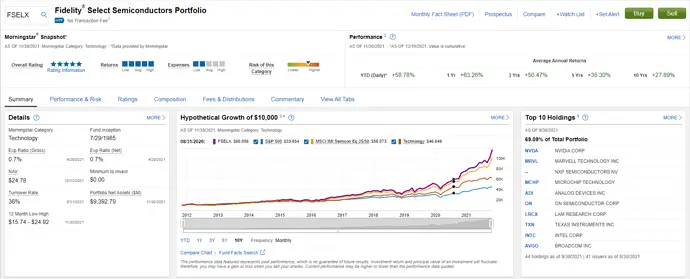

What y’all think about FSELX? I see it has a great return in the past 10yrs. Would it be a good investment to add to Roth IRA?

Comments

Chris G:

Good pick. Semiconductors are in so much of what we buy today. I bought some to put in my kids UTMA accts.

Craig D:

FSELX is a fantastic fund. I bought it 2 months ago in my Roth, and it’s up over 11% since then.

Steven W:

I was just looking at this today. Wonder how much I should allocate. Right now I’m 100% FBGRX. Will need to diversify for inflation.

Davis G:

I’ve considered FSELX before I went for SMH last June 2020 due to a lower expense ratio and high volume. Up 107%. The following comparison from 5-year chart as of now. FSELX: 154.69% and SMH: 321.80%.

Mike P:

FSELX is the best mutual fund. But, that’s because their performance of the last 2 years. And most likely due to NVDA. Close to 25% of their holdings. Plus, after easily doubling their return since the pandemics, are there any stellar return in the near future? Plus, any corrections in the market/sector, losses will be double what the overall market. Good luck!

Ricky C:

It’s a solid mutual fund. I own some and have been in since 2019. Up over 150% in 2.5 years. NVIDIA is one of their leading holdings and that is a great stock both with graphics cards for gaming and crypto mining rigs.

Jason P:

I have PSI and it has done VERY well for me. I waffled between SOXX and PSI, decided on PSI, and am very happy.

1 post – 1 participant