Emergency Fund First Before maximizing retirement contributions, ensure you have adequate emergency savings. Aim for 3-6 months of essential expenses in an easily accessible account.

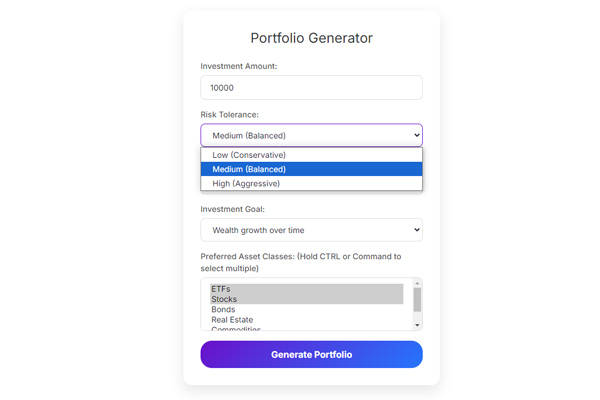

Set-up Your Retirement/Investment Strategy

As with most things, to create new behavioral habit you will stick to, the best time to adjust your investment strategy is at the start of a new year with a fresh clean slate devoid of imperfections!

Administrative Updates

After review your current contribution rate, consider increasing your contribution if you’re not already maxing out

Check your investment allocation

Update your beneficiary information.

- Traditional IRAs:

- Roth IRAs: Individuals under 50 can invest up to $7,000, or $8,000 for those 50 or older. These limits apply to traditional IRAs as well.

Review Your Contribution Max

Consider setting up a recurring transfer schedule with Fidelity’s Smart Habits feature, which can help you gradually increase your savings throughout the year. Remember, the key to successful investing isn’t just about how much you contribute – it’s about consistency and making informed decisions aligned with your long-term goals.

Retirement/Investment Considerations for 2025

One of the most powerful moves you can make is setting up automatic contributions to your Fidelity accounts. Consider using Fidelity’s recurring investment feature to ensure consistent savings throughout the year8. Emergency Fund First Before maximizing retirement contributions, ensure you have adequate emergency savings. Aim for 3-6 months of essential expenses in an easily accessible account.

Review Contribution Max

After review your current contribution rate, consider increasing your contribution if you’re not already maxing out

Check your investment allocation

Update your beneficiary information.

Leverage Tax Advantaged Accounts

Remember to leverage tax-advantaged accounts like your Fidelity 401k, IRAs, and HSAs. These retirement investment vehicles can help amplify your tax savings through tax benefits.

Investing Strategies in 2025

Whether you’re just starting your investment journey or you’re a seasoned investor, these updates for 2025 provide excellent opportunities to optimize your financial future.

Automate Your Investing

One of the most powerful moves you can make is setting up automatic contributions to your Fidelity accounts. Consider using Fidelity’s recurring investment feature to ensure consistent savings throughout the year.

Diversification

The market is showing interesting opportunities in small- and mid-cap stocks, which have gained momentum recently. Consider reviewing your portfolio allocation to ensure you’re not overly concentrated in any one area2. Sector Focus Consumer discretionary stocks are showing promising signals, with attractive valuations and strong earnings growth. This could be an area to consider for portfolio diversification.

Even Dave Ramsey