VUG and VONG are popular growth index funds from Vanguard. They have a lot in common but differ in some aspects.

If you’re looking at these two funds and trying to figure out which one is right for you, here’s what you need to know.

| Funds | Vanguard Growth Index Fund ETF | Vanguard Russell 1000 Growth Index Fund ETF |

|---|---|---|

| 3-year total return | +13.69% | +14.41% |

| 3-year standard deviation | 22.95% | 22.24% |

| Morningstar rating | 4/5 | 5/5 |

| Min. initial investment | — | — |

| Net expense ratio | 0.04% | 0.08% |

| Total net assets | 74.22bn USD | 7.29bn USD |

| Symbol | VUG | VONG |

| Morningstar category | Large Growth | Large Growth |

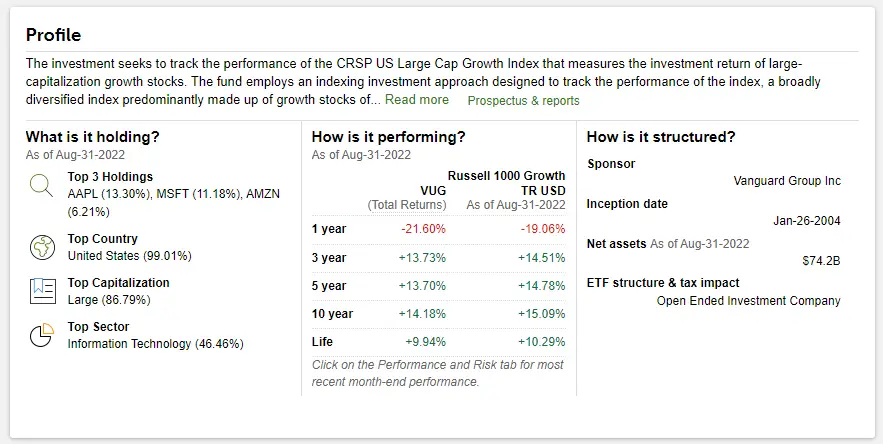

VUG: Vanguard Growth Index Fund ETF

VUG is a fund that invests in stocks on the CRSP US Large Cap Growth Index. The fund tracks a comprehensive index of large-cap growth stocks.

It has a relatively low turnover rate, meaning it buys and sells its holdings irregularly. This can result in lower transaction costs than other funds with higher turnover rates.

VUG also has below-average expenses at 0.04% because Vanguard keeps costs low across its entire lineup of funds.

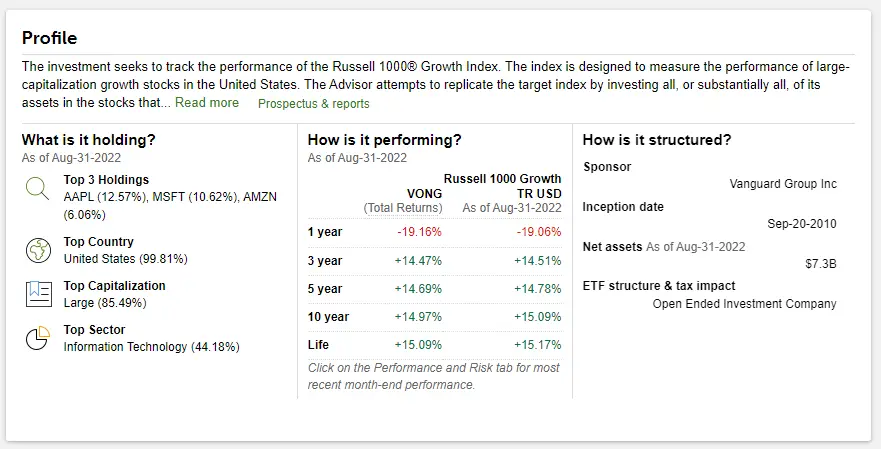

VONG: Vanguard Russell 1000 Growth Index Fund ETF

VONG is a growth fund that invests in U.S. companies within the Russell 1000 Growth Index.

The VONG ETF has an expense ratio of 0.08%, which makes it more costly than VUG, and it does have a high turnover rate of 14%.

VUG vs VONG: Key differences

The biggest difference between these two funds is that VUG has a lower expense ratio than VONG.

In addition, VUG’s market capitalization is greater than its contender ($74 billion vs. $7 billion).

In terms of index tracking, both ETFs track different but similar indexes.

VUG vs VONG: Which Vanguard Growth ETF Is Better?

If you’re looking for a growth ETF with a diverse portfolio of companies, VUG is the way to go.

It has an expense ratio of 0.04% and trades on the Nasdaq exchange.

This fund invests in large-cap stocks with above-average growth rates, which give investors higher returns than other types of investments.