Fidelity money market funds like SPAXX, SPRXX, and FDLXX, are offering yields north of 4.9%. Unsurprisingly, investors are leaving their money inside their core position rather than investing it elsewhere.

Some investors on Reddit are wondering what would happen to these Fidelity money market funds in the event of a government shutdown.

Specifically, how long can they maintain prices at $1?

In today’s blog post, let’s explore Fidelity’s track record in weathering economic storms.

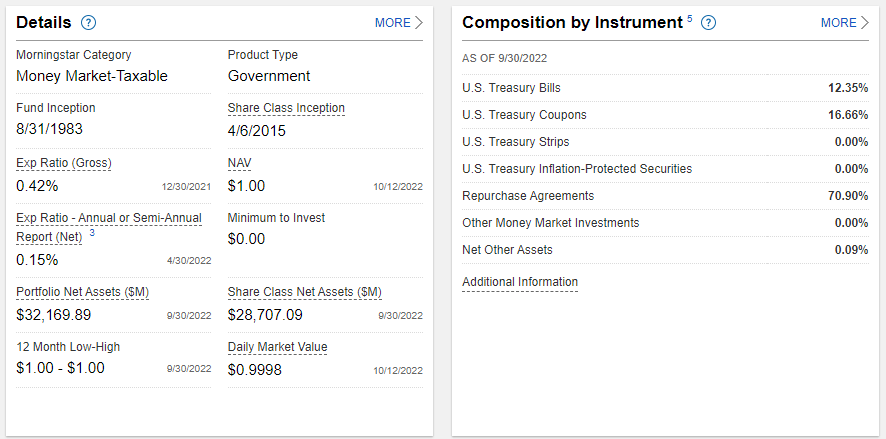

How Safe Is Fidelity Money Market Fund SPAXX?

When it comes to financial stability, Fidelity has an impressive track record.

Even during the 2008 recession and previous government shutdowns, they never broke the buck.

This means that their money market funds, such as SPAXX and FZFXX, never fell below the $1 mark, providing reassurance to investors during turbulent times.

Examples of Money Market Funds Falling Below $1

In the past, there were two notable instances where money market funds from other providers dropped below the $1 threshold.

The first occurred in 1994 with Community Bankers US Govt MM, a smaller institutional fund with an AUM of 82 million. Their use of derivatives worked against them, liquidating $0.96 per share to shareholders.

The second instance transpired during the 2008 financial crisis with the Reserve Primary MM, a massive fund with an AUM of 64 billion.

They held a significant portion of Lehman Brothers’ commercial paper, which became worthless following Lehman Brothers’ collapse. This led to a drop in value to $0.97 and eventual liquidation.