Someone asks:

Does anyone use Excel or Google Sheets to analyze and track their Fidelity portfolio? I used Fidelity’s “download” feature to export a CSV file which I’m now formatting into a basic spreadsheet. But this is labor-intensive, and keeping up with it won’t be fun.

How to Export your Fidelity Portfolio Data

There are two ways to export your trades from Fidelity. You can do so on the Fidelity website or via the Active Trader Pro software.

To download your trade data via the Fidelity website:

- Login to your Fidelity account.

- Select an investment account (if you have more than one Fidelity account).

- Click on Positions.

- Click on the Download icon on the right-hand corner of your Overview row.

- A CVS file containing your trade data will be downloaded to your computer.

To download your trade data through the Active Trader Pro platform:

- Open Active Trader Pro on your computer.

- Login using your Fidelity account.

- Select Accounts at the top left and select Positions.

- Click the arrow to the left of a ticker symbol to view its details.

- Right-click and select Download. Choose between “.csv” or “excel.”

What Data Is Included in the CSV File?

Your “Portfolio Positions” file will contain the following information:

- Account Number

- Account Name

- Symbol

- Description

- Quantity

- Last Price

- Current Value

- Today’s Gain/Loss

- Total Gain/Loss

- Percent of Account

- Cost Basis Per Share

How To Export Your Fidelity Transaction Data

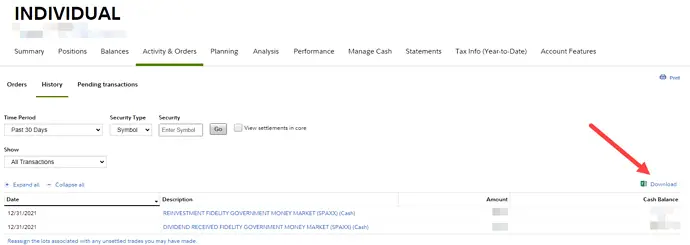

Here’s how to export your entire account history to a spreadsheet.

- Login to your Fidelity account.

- Head over to the Activity & Orders tab.

- Click History.

- Filter your data before exporting it as a CSV file. You can adjust the following fields: Time Period, Security Type, and Type of Transaction.

- Click on the Download button with an Excel icon next to it.

Conrad M:

I built an excel dashboard using my Fidelity CSV data. It’s automated and coded to notify me which of my stocks are at buy points or sell points automatically.

I update the price targets once a month, whenever there is news, or what analysts say the stock’s price target is. Then I match that with the current stock price. Every morning the price updates once I download the data, and it will highlight green or red if it hits the price point to buy or sell.

Jackie K:

Yes, I have several excel sheets I built myself. There are things my watchlist and portfolio don’t tell me!

And I want it formatted a particular way. Excel’s stock data tool is super nifty. As you stated, all very labor-intensive but I like MY OWN formatting, and I get a big kick out of it.

John K:

I do have an Excel sheet with my Fidelity portfolio in it. I also have my Fidelity linked to Yahoo Finance.

1 post – 1 participant