Two of the most popular index funds are SWTSX and VTSAX. They both track different benchmarks, with SWTSX following the Dow Jones U.S. Total Stock Market Index and VTSAX following the CRSP US Total Market Index.

When comparing the two, it’s important to consider their expense ratios, growth potential, holdings, and benchmark performance.

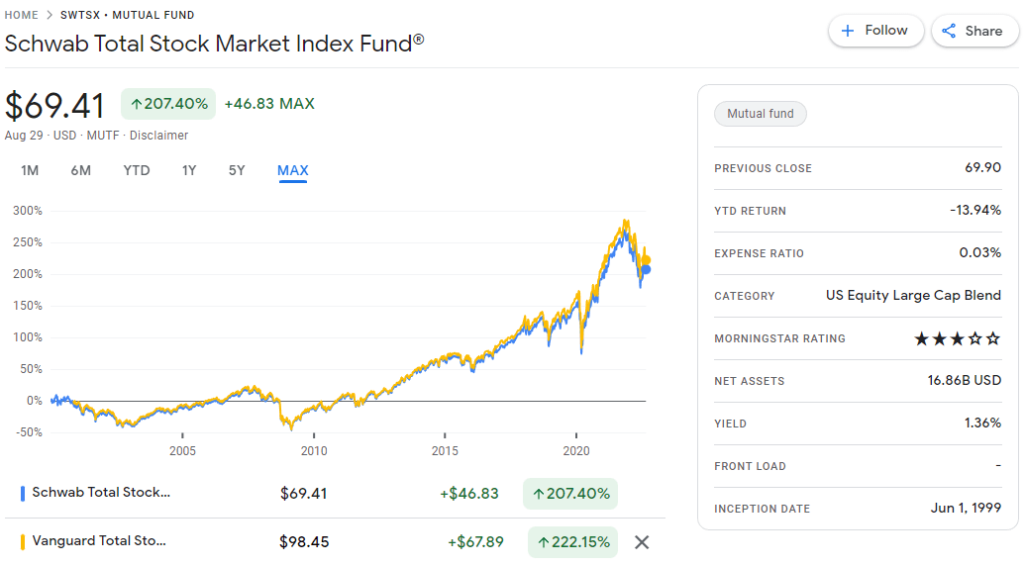

SWTSX has an expense ratio of 0.03% and VTSAX has an expense ratio of 0.04%. This means that for every $10,000 invested in SWTSX, you would pay $3 in annual fees. For VTSAX, you would pay $4 in annual fees. Both funds have low expense ratios, but SWTSX is slightly cheaper.

In terms of growth potential, both funds have historically had similar returns. Over the past 10 years, SWTSX has returned 12.03% per year and VTSAX has returned 12.11% per year.

SWTSX vs. VTSAX: Comparison Details

| Funds | Schwab Total Stock Market Index Fund® | Vanguard Total Stock Market Index Fund Admiral Shares |

|---|---|---|

| 3-year total return | +12.36% | +12.42% |

| 3-year standard deviation | 20.01% | 19.98% |

| Min. initial investment | 0.00 USD | 3,000.00 USD |

| Net expense ratio | 0.03% | 0.04% |

| Total net assets | 16.86bn USD | 295.05bn USD |

| Morningstar category | Large Blend | Large Blend |

SWTSX vs. VTSAX: Which one is better?

There are many factors to consider when choosing between SWTSX and VTSAX. Both are excellent index funds, but each has its own strengths and weaknesses.

SWTSX and VTSAX are index funds for the global stock market. This means that you get exposure to companies outside of the U.S.

SWTSX has a lower expense ratio than VTSAX, which means it costs less to invest in SWTSX. However, VTSAX has a higher return on investment than SWTSX.

Ultimately, it depends on your investment goals as to which fund is better for you. Both funds are incredibly similar.