Are you looking to transfer your Stash portfolio to Fidelity? You’ve come to the right place.

In this tutorial, I will walk you through the process step-by-step.

How to Transfer from Stash to Fidelity

When transferring investments from Stash to Fidelity, it’s important to make sure that the process is done correctly.

Here are the steps you need to take:

Step 1: Create an account with Fidelity. If you already have an account, move on to the next step.

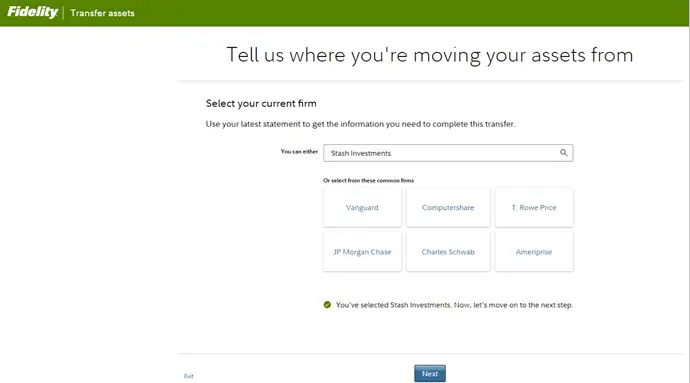

Step 2: Go to the Transfer of Assets page.

Step 3: Enter Stash Investments as your current firm. If the option is not there, you can select Apex Clearing.

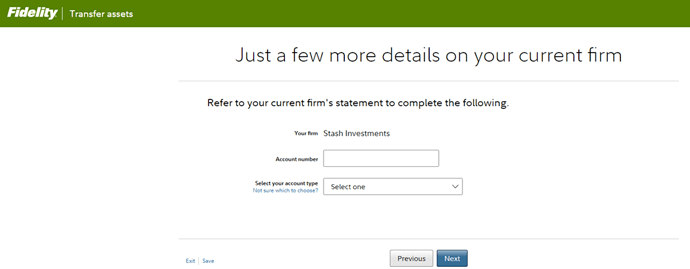

Step 4: Provide your Stash account number. You can find this information in your Stash’s account statement.

Step 5: Select your account type and click Next.

Step 6: Finish the rest of the on-screen instructions and submit your request.

Note: When you initiate the transfer request from Stash to Fidelity, the fractional shares in your portfolio will likely be converted to cash. Full shares can still be transferred over to your Fidelity account.

How Long Does It Take To Transfer From Stash to Fidelity?

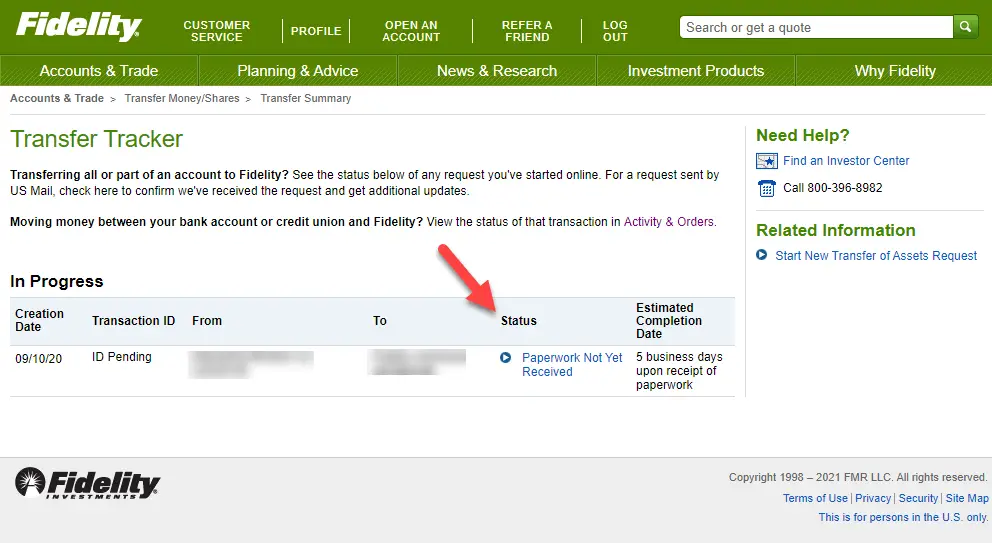

The transfer process for stocks from Stash to Fidelity through an ACAT request typically takes 3-5 days. However, there have been cases where the transfer took up to two weeks.

Fidelity customers can use the Transfer Tracker to keep track of their transfer status.

How Much Does It Cost To Transfer Out of Stash?

An ACAT transfer from Stash incurs a fee of $75, which will be deducted from your account balance. It’s worth noting that once the ACAT transfer process has begun, your Stash account will be locked.

In case you wish to have the fee reimbursed, you can reach out to Fidelity, as they may be able to reimburse the ACAT fee for you.

💬 Community Discussion

Justin H:

I recently transferred from Stash to Fidelity, and in my experience, Fidelity is much better!

- Fidelity offers real-time trades, unlike Stash which has trading windows.

- Fidelity does not charge any fees, whereas Stash does.

- Stash has limited equity (stock) offerings, Fidelity has entire stock market plus OTC stocks.

From what I hear Fidelity’s customer service is spectacular, even though I have not had to use it. Stash’s customer service sucks.

There are a few down sides to Fidelity but it is more related to app responsiveness and features that I think Fidelity should implement but nothing that I feel has hindered my trading, which to me is the most important part.

Fractional shares don’t transfer so I skipped the transfer + fee. I just took screenshots of all holdings in Stash, sold everything, and repurchased on Fidelity.

It took a few days because I had a lot of holdings but I was able to do this pretty quickly all on my own. I have heard that Fidelity may cover the transfer fee if you’d rather go that route. I am loving Fidelity so far.

Nick P:

Stash charges a fee when you close your account. In my opinion, Fidelity is the clear winner.

Ricky C:

When transferring from Stash to another brokerage, you will be charged a fee of $75. Also, if you have any fractional shares either through purchases or dividend reinvestments, I believe you can only transfer whole shares from one brokerage to the other.

Micky M:

I initiated the transfer from Stash to Fidelity on Tuesday; at the time, my portfolio had $2,000 in cash.

The process involved selling my fractional shares and transferring the whole shares to Fidelity.

This left me with cash that I could invest in my Fidelity account. I am currently waiting for the reimbursement of the $75 transfer fee.