When depositing money into your Fidelity brokerage account, it’s important to know how the process works and what to expect.

In this guide, we’ll break down everything you need to know about Fidelity instant deposit and timeframe, including insights from the community.

Does Fidelity Have Instant Deposit?

While your funds are in the process of settling, Fidelity offers a good faith credit so you can start trading.

However, keep in mind the following:

- You can trade with up to $25,000 of uncollected funds immediately after the deposit if the EFT was initiated through a Fidelity platform.

- Securities trading under $3/share and options contracts are not eligible.

- Be cautious, as selling a security before it fully settles may trigger a Good Faith Violation.

As you can see, Fidelity does not explicitly say they offer “instant deposit” like Robinhood, but the minute you trigger an EFT deposit into your Fidelity account, the fund becomes available to trade.

How To Add Money to Fidelity Account

There are multiple ways to deposit funds to your Fidelity account. Most people opt-in for EFT, wire transfer, and mobile check deposits.

Method #1: Electronic Funds Transfer (EFT)

EFT is a cash transfer using the Automated Clearing House (ACH) system. It’s free and usually takes 1 to 3 business days to arrive. However, it can take up to 6 business days for your funds to fully clear.

Method #2: Wire Transfer

Bank wires initiated by your sending institution can arrive on the same or the next day and are immediately available upon receipt. Fidelity doesn’t charge fees for sending or receiving bank wires.

Method #3: Depositing Checks

You can deposit checks using the Fidelity mobile app or by mail. Checks have a collection period of 2 to 6 business days after being received.

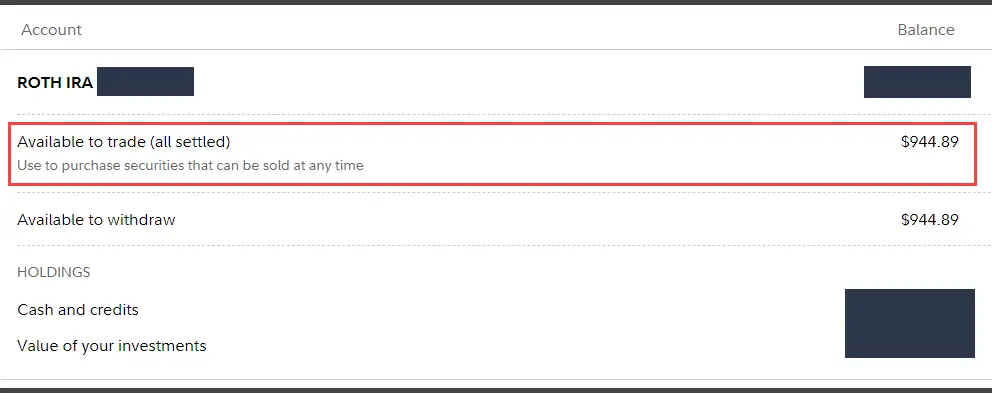

How To Monitor Your Fidelity Balance

To keep track of your funds, follow these steps:

- Go to Accounts & Trade > Portfolio.

- Select the Balances tab.

- Choose the desired account, if you own more than one.

- The Available to trade figure shows the specific dollar value available for trading.

Quick Tips From the Community

Immediate Availability for Trading: Some users have reported immediate availability for trading after initiating a transfer. These funds are considered unsettled but are categorized as “Cash available to trade.”

Margin Trading: If you have margin turned on, it may grant you access to funds for trading even before they fully clear.

Check Your Securities Value: If you have over $2,000 worth of securities in your account, you might not have to wait for funds to clear before making trades.

In Summary

While Fidelity doesn’t offer instant deposits like Robinhood, there are methods to expedite the process.

Electronic Funds Transfers and bank wires are faster options, and you can start trading with uncollected funds (up to $25,000) immediately after the deposit. Just remember to exercise caution to avoid any trading violations.

Very disappointing that Fidelity cannot settle funds from a bank in 6 business days.

When I buy or sell a house in another state the transaction can happen that day.