Someone asks:

Is it okay to have both FXAIX and FNCMX? Fairly new to mutual funds and just trying to figure out everything!

Answers:

Gerry S:

I have both…noticed they moved in different directions a lot last year, so it appears they have some negative correlation. Don’t worry if there is some overlap, as that is almost inevitable once you have several funds.

Andrew G:

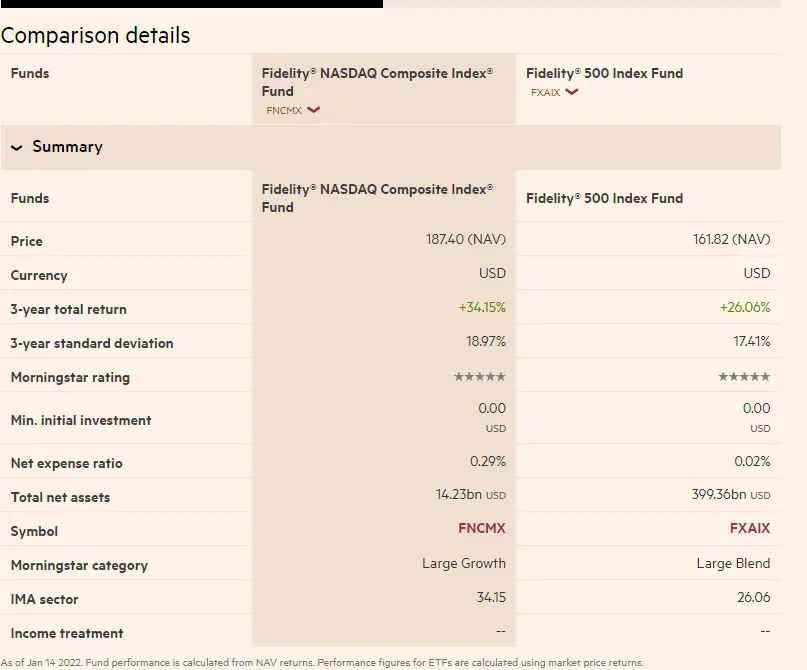

There’s some considerable overlap because many of the NASDAQ stocks are in the S&P 500. If you’ve actively decided that you want to tilt your portfolio in a tech-heavy way, then this is appropriate.

I’m a total market index guy. For extra return, I would generally recommend value stocks as a tilt rather than a sector. I think tech stocks are sufficient fly recommended in the broader index.

Phillip P:

I’m in the process of rebalancing, doing a little bit of portfolio cleaning. I have FNCMX (Nasdaq Index Fund), and am thinking of switching this one to FOCPX to get more of an aggressive growth type fund. I like the fact that FOCPX also has weights in smaller companies and it has a great track record.

Kevin L:

FNCMX has much lower fees because it is an index fund that mirrors the Nasdaq Composite Index. These two will have a ton of overlap with Nasdaq weighing heavier in the technology sector. Both are large cap growth funds with comparable track records. You can’t go wrong with either.

1 post – 1 participant