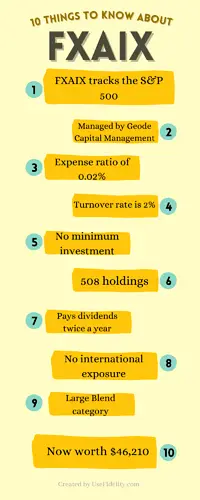

The following are essential things to know about FXAIX (Fidelity 500 Index Fund) before putting your money into it.

FXAIX tracks the S&P 500

The Fidelity 500 Index Fund (FXAIX) is a mutual fund that tracks the S&P 500 index by investing at least 80% of its assets in the largest companies within the United States.

Managed by Geode Capital Management

Geode Capital Management is currently in charge of FXAIX. The fund manager has been at the realm of the fund since 2003.

Expense ratio of 0.02%

The expense ratio of the Fidelity 500 Index Fund is only 0.02%. FXAIX has one of the lowest fees in its category.

You want to keep this fee as low as possible because it will quickly eat into your return in the long run.

Turnover rate is 2%

FXAIX has a turnover rate of 2%. The turnover rate indicates how frequently the mutual fund’s holdings changed over the previous year.

Mutual funds with a high turnover rate may be more expensive for investors.

There is no minimum investment requirement

Unlike many Vanguard mutual funds, investors who choose to invest in FXAIX are not required to put in a minimum amount. The usual minimum investment from Vanguard is $2,500 – $3,000.

Since FXAIX doesn’t require a minimum investment, you purchase it as you go.

508 holdings as of 12/31/2021

Since FXAIX follows the S&P 500 index, it’s not hard to guess how many stocks are in the fund.

Top 10 holdings (29.29% of Total Portfolio)

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Apple Inc. | AAPL | 6.67% |

| Microsoft Corp. | MSFT | 6.38% |

| Amazon Inc. | AMZN | 3.92% |

| Tesla Inc. | TSLA | 2.39% |

| Alphabet Inc. Cl A | GOOGL | 2.19% |

| NVIDIA Corp. | NVDA | 2.09% |

| Alphabet Inc. Cl C | GOOG | 2.06% |

| Meta Platforms Inc. | FB | 1.99% |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.32% |

| JPMorgan Chase & Co. | JPM | 1.22% |

Pays dividends twice a year

FXAIX pays dividends to its shareholders every April and December. The dividend yield is 1.22%.

No international exposure

FXAIX is probably not the best fund to invest in if you want exposure to international companies. The asset allocation of FXAIX is 99.99% in domestic equities.

Fidelity 500 Index Fund is in the Large Blend category

Morningstar categorized FXAIX as a Large Blend. This means that the fund only invests in companies with a market capitalization of more than $10 billion. The Large Blend category includes funds that invest in a mix of growth and value stocks.

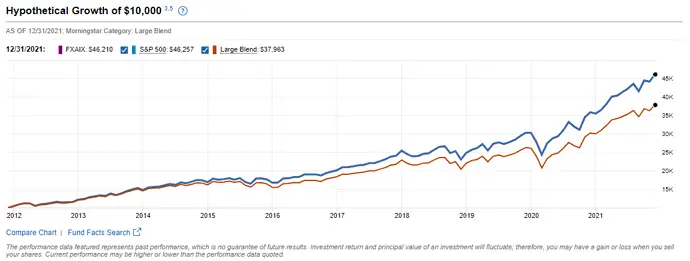

$10,000 invested in FXAIX

Is FXAIX a good investment? Let’s find out by using the hypothetical growth method.

$10,000 invested in FXAIX in 2012 (10 years ago) is now worth $46,210.

The average annual return of FXAIX is 16.54% (over the past 10 years).

In a hurry? Save the infographic below for later!

Compare FXAIX Against Other Mutual Funds

- FXAIX vs. VFIAX

- FXAIX vs VOO

- ARKK vs. FXAIX

- FZROX vs. FXAIX

- FBGRX vs. FXAIX

- FXAIX vs. SPY

- FNILX vs. FXAIX

- FXAIX vs. FSKAX

- FNCMX vs. FXAIX

1 post – 1 participant