A trailing stop-loss order is an order to sell a security when it falls below a certain price. This order type is intended to “trail” the price of the security.

When you have a long or short position in a stock or option, you can use a trailing stop-loss order to protect against losses.

There are several ways to set up a trailing stop-loss order on Fidelity. You can use the online tool or call customer service to place the order.

How to Place a Trailing Stop Loss Order on Fidelity

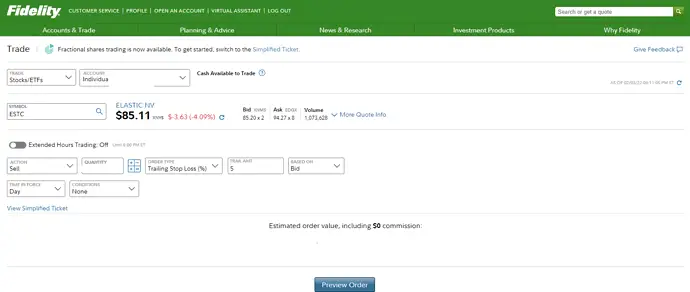

- First, log in to your Fidelity account and click on Trade.

- In the Trade window, choose your investment account, enter the ticker symbol, action (Buy or Sell), and enter the quantity.

- Under Order Type, you can select Trailing Stop Loss based on the dollar amount or percentage amount.

- Enter the trail amount and what the amount should be based on (last price, bid, or ask).

- Click Preview Order.

- Finalize and submit your order to Fidelity.

Fidelity Error 010962

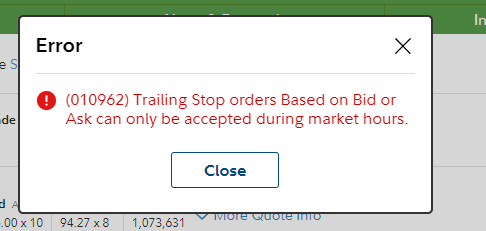

If you place a trailing stop-loss order outside of market hours, you have to set it to follow based on the “last price,” or else Fidelity will throw you this error message.

(010962) Trailing Stop orders Based on Bid or Ask can only be accepted during market hours.

What Is a Good Trailing Stop Percentage To Use?

John K:

I like 6-7% if I am ready to sell. I like 11-12% if I really just want to protect my gains.

Jason P:

I use 1/2 of my standing target gains. I’ll set a standing order point at 10% gain and 5% loss, or 15% gain and 7.5% loss, or 20% gain and 10% loss, etc.

1 post – 1 participant