If you’re a US citizen and find yourself subjected to backup withholding on your Fidelity account, there’s a straightforward process to address this issue.

Backup withholding is typically imposed by the IRS if there’s an issue with your Social Security Number (SSN) or Taxpayer Identification Number (TIN) certification, such as a name mismatch due to a typo or a name change, for instance, after marriage.

To rectify this, follow these steps:

How to Stop Fidelity from Withholding Your Taxes

Option #1: Verify Your SSN or Taxpayer ID

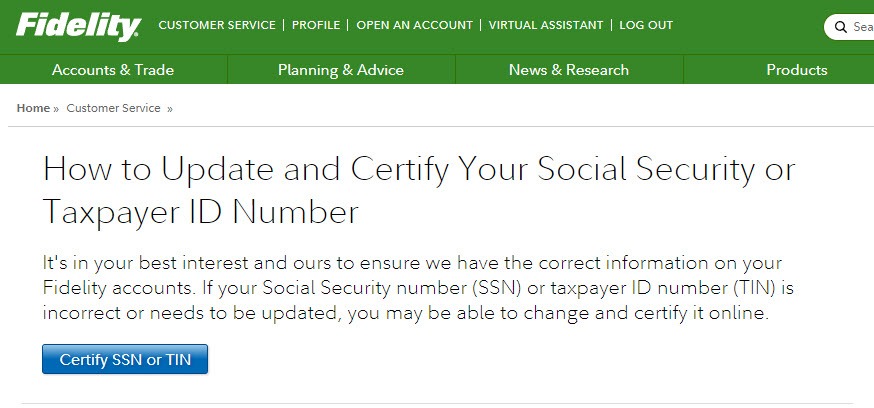

Start by confirming that all your information, particularly your SSN or TIN, is correctly registered with Fidelity.

You can do this by visiting this page.

Click on Certify SSN or TIN to begin the process.

Option #2: Submit Form W-9 to Fidelity

In most cases, you’ll need to submit a Form W-9. This form is crucial for confirming your taxpayer ID and declaring that you are not subject to withholding. It’s an essential step in preventing backup withholding.

Option #3: Check for Specific Security Type

Remember that if you’re dealing with foreign securities, withholding may be mandatory and cannot be turned off.

For instance, if you invest in stocks from a non-US company, Fidelity might withhold a certain percentage.

Option #4: Is It a 401K Distributions?

If you’re dealing with a 401K distribution, there’s typically a 20% mandatory tax withholding.

This is different from IRA distributions, where you have the option to choose whether or not to have taxes withheld.

I hope that helps. You can always reach out to Fidelity customer service for additional help.