Have you ever experienced the frustration of having your Fidelity debit card declined, even when you knew you had enough money in your account?

Many Fidelity Cash Management account holders face this issue, which can be inconvenient.

In this post, we’ll explore common reasons for these declines and provide practical steps to help you get your transaction through.

Why Was My Fidelity Debit Card Declined?

1. Funds Availability

One common reason for a declined transaction is that the funds may not yet be available for withdrawal.

If you recently sold securities or transferred funds into your Fidelity Cash Management Account (CMA), it’s important to know that settlement times can vary.

Typically, funds settle within 1-2 business days after the trade date.

For recent deposits, it may take up to 6 business days for them to be fully available.

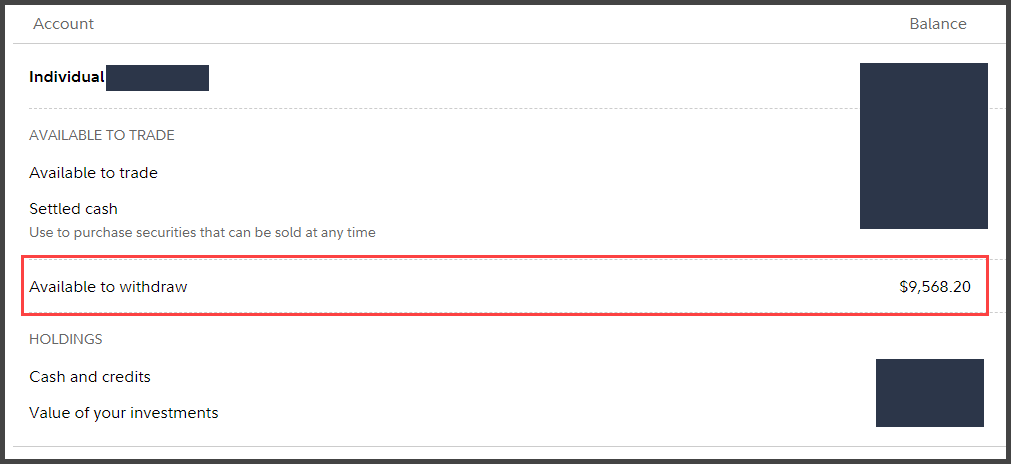

Here’s how to check your Fidelity’s available cash balance:

- Head over Accounts & Trade.

- Click on Portfolio.

- Click on your account.

- Select Balances.

- Look at the figure from Available to Withdraw. That’s how much you can spend with your debit card.

2. Daily Withdrawal Limit

Another factor to consider is the daily withdrawal limit imposed on your Fidelity debit card.

This limit is set to protect your account from unauthorized or excessive withdrawals. You can review your limit on the Fidelity website:

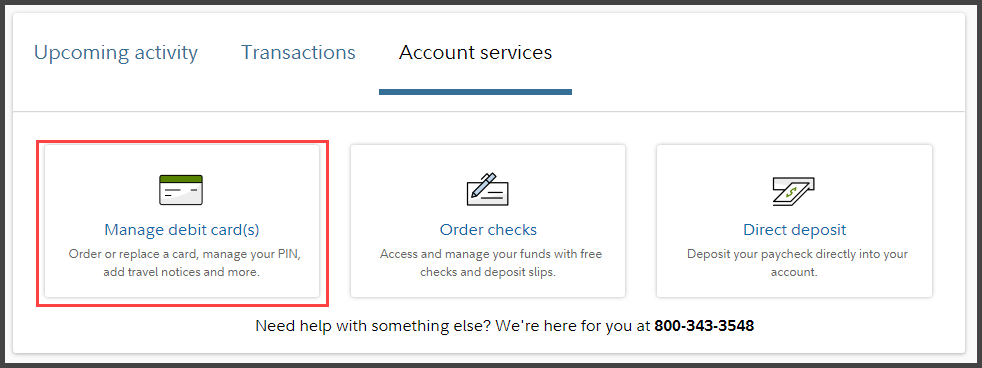

- Click on Accounts & Trade > Cash Management.

- Click on your account.

- Select Account Services and then Manage debit card(s).

3. It’s Not Fidelity, It’s Visa!

Sometimes, Visa can decline transactions without providing a clear reason. This is not uncommon, as these decisions are often made algorithmically.

In Summary

It’s not often that Fidelity debit card gets declined for unknown reasons. Before you panic, check your available funds and be aware of your daily withdrawal limits.

As a Fidelity Cash Management account holder, you can always contact the Fidelity support team for further assistance.