Now that Fidelity offers crypto trading to the public, it’s time to talk about taxes.

If you buy and sell crypto on the Fidelity platform, you’ll either make a profit or a loss, and you need to report that on your taxes.

So, how does the brokerage handle tax reporting for Bitcoin and Ethereum trades?

Let’s find out.

Fidelity Crypto Tax Forms & Reporting

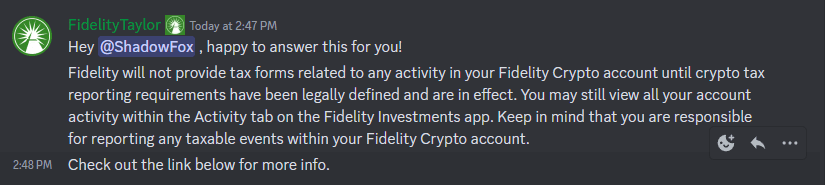

Fidelity will not issue tax forms related to activity in your Fidelity Crypto account until the crypto tax reporting requirements have been legally defined and are in effect.

You can still monitor your account activities, including crypto trades, by visiting the Activity tab on the Fidelity website or mobile app.

Lastly, you are responsible for reporting any taxable events within your Fidelity Crypto account.