Someone asks:

I have 5 index funds in my Roth but thinking of trimming it down to FTIHX.

The reason I did this was because they didn’t truly fit my allocation. FZROX isn’t a “true” total market fund. It’s missing ~1000 companies. FZILX is missing international small cap companies. Thoughts?

What is the minimum investment amount for FTIHX mutual fund?

The minimum to invest in FTIHX is $0.

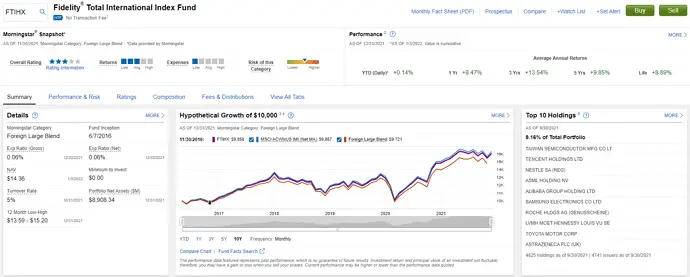

What is the expense ratio of FTIHX?

The expense ratio for FTIHX is 0.06%.

Is FTIHX a good investment?

John D:

I like it and use both as my core stock holding. FSKAX and FTIHX basically gets you all the stocks in the world. Fidelity and other firms stress the importance of international diversification, so I personally wouldn’t let recency bias limit my portfolio to US stocks, but everyone is different.

Sean M:

One of my favorites with Fidelity is Fidelity’s Total International Index Fund (FTIHX), which includes 4,797 stocks from around the world (both developed and emerging markets), and being very low-cost (expense ratio is 0.06%). In my opinion, it complements FXAIX nicely.

Allen S:

I like FEMKX. For an international index fund, I have the Vanguard VWIGX which is doing my pretty good. I think you have to pay $75 Fidelity fee though.

1 post – 1 participant