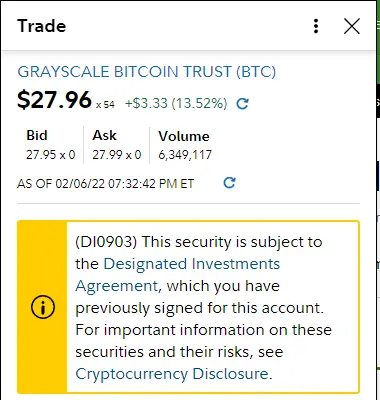

If you’re about to purchase ETFs like JEPQ or GBTC on Fidelity, you may have uncovered Fidelity’s Designated Investments Agreement.

It’s completely natural to hesitate before blindly accepting something you don’t fully understand.

(DI0903) This security is subject to the Designated Investments Agreement, which you have previously signed for this account.

In this article, we’ll break down Fidelity’s Designated Investments Agreement in plain and non-legal terms.

What Is Designated Investments Agreement on Fidelity?

Brokers like Fidelity categorize investments based on their associated risk levels.

When you agree to the Designated Investments Agreement, you’re essentially stating that you’ve done your due diligence. And most importantly, you’re willing to absolve Fidelity of any responsibility for the outcomes.

In the given example above, JEPQ is a complex ETF, and even the most risk-tolerant retail investor may not fully comprehend the risk at hand.

That’s why many of these securities require additional attestations, similar to those that are required for alternative investments.

Once the agreement is signed, Fidelity will allow you to finalize and submit your order for processing.