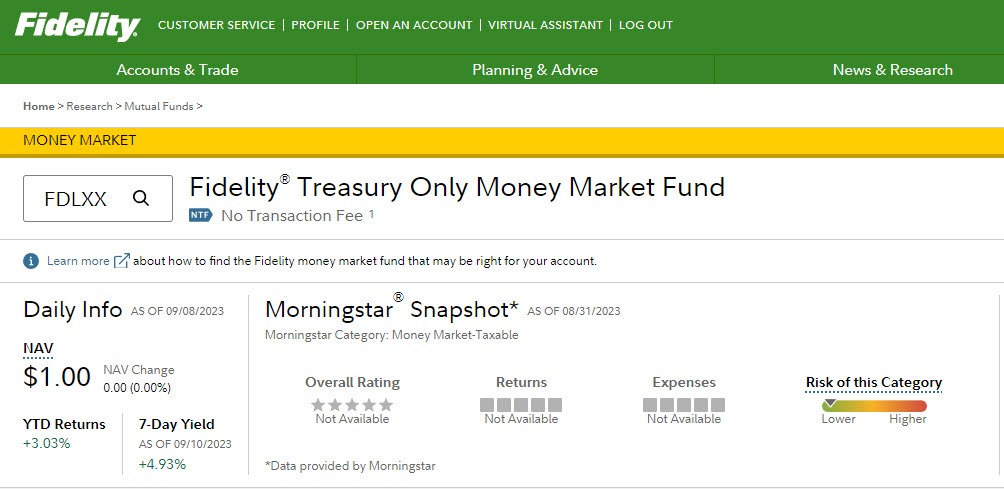

One common question around Fidelity’s Treasury Only Money Market Fund, FDLXX, is its state tax exemptions.

To shed light on this matter, this blog post will delve into how Fidelity handles FDLXX on tax forms and what investors need to keep in mind.

How Fidelity Handles FDLXX on Your Tax Forms

According to a Reddit thread, Fidelity follows a streamlined process for tax reporting.

For non-retirement accounts, they issue a consolidated 1099 form, which provides a comprehensive overview of all investment activities. This includes any income earned from holding FDLXX or any other investments.

However, it’s important to note that while Fidelity provides this consolidated statement, it doesn’t offer specific advice on how to file your taxes.

Investors are encouraged to seek guidance from a qualified tax professional who can provide personalized advice based on their individual circumstances.

Fidelity will provide a document each year regarding the percentage of income derived from U.S. government securities and which portions are exempt from state taxes.

Here is an example document from last year.