FXAIX and VFIAX are two of the most popular funds that track the S&P 500 Index.

But which one is better? Let’s look at how each fund stacks up against the other and their fees and performance.

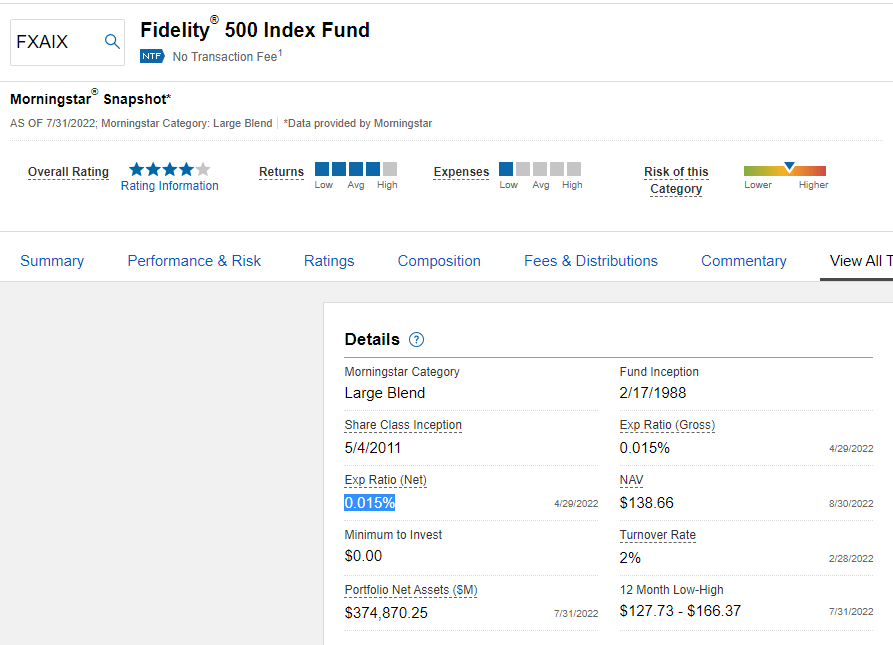

FXAIX: Fidelity® 500 Index Fund

The Fidelity® 500 Index Fund is a passively-managed index fund that invests in large-cap stocks — effectively following the S&P 500. It has a very low expense ratio of 0.02%, and there are no minimum investment requirements.

FXAIX is perfect for investors with a long time horizon and goals of diversifying their portfolio with large-cap stocks.

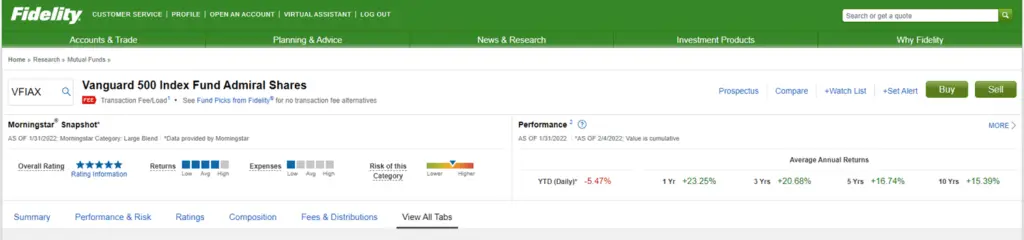

VFIAX: Vanguard 500 Index Fund

VFIAX is the Vanguard 500 Index Fund. The fund tracks the S&P 500 and has $379.2 billion in AUM. It has a 0.04% expense ratio.

VFIAX has been around since 2000, which makes it one of the oldest funds on this list with consistent performance and low fees.

FXAIX vs. VFIAX: Key differences

FXAIX has lower expenses than VFIAX: 0.04% vs 0.02%. If you were to put $10,000 into VFIAX, you’d be paying Vanguard $4 every year as an annual fee.

The minimum initial investment required for VFIAX is $3,000. This means if you have less than this amount, you won’t be able to invest in the Vanguard 500 Index Fund Admiral Shares.

FXAIX, on the other hand, has no minimum investment. You can buy shares of the Fidelity 500 Index Fund with low dollar amounts — think $45 or $50.

FXAIX vs. VFIAX: Which Is Better?

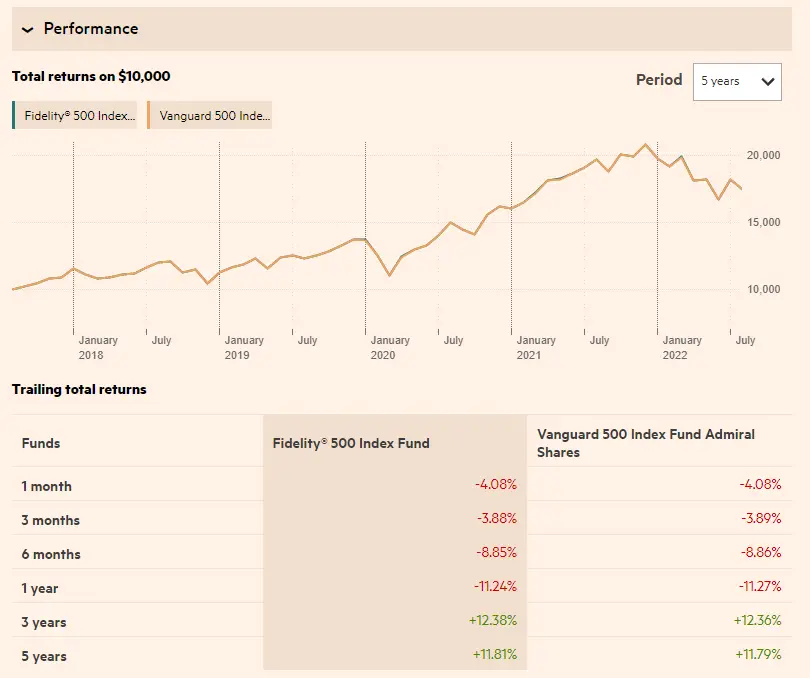

In the last 5 years, the average annualized return for VFIAX was 11.79%, while the average annualized return for FXAIX was 11.81%.

While both funds had identical returns, FXAIX’s expense ratio of 0.02% can save investors additional money.

Lastly, it will cost $75.00 in transaction fees for every time you buy VFIAX through Fidelity.

FXAIX is a better choice if you want to invest in the S&P 500 index because of its lower costs and an equal or better track record regarding returns over time.