What are the key differences between FZROX and FXAIX? While both funds are good investments, FZROX has some advantages over FXAIX.

First, it has no fees. Second, it tracks the total stock market, while FXAIX only tracks the S&P 500. This means that FZROX gives you exposure to a wider range of stocks.

Someone asked:Which is a better investment option for a Roth IRA: FZROX or FXAIX? I am rolling over pre-tax 401k money into a Fidelity retirement account. Can you provide some advice and guidance?

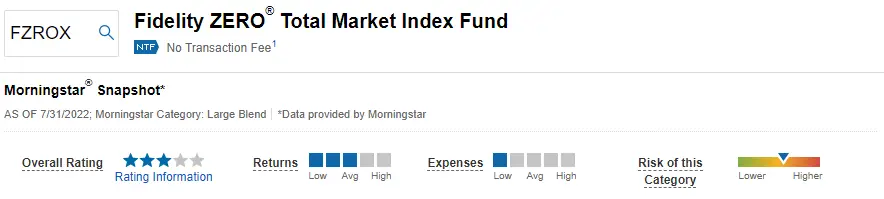

FZROX: Fidelity ZERO Total Market Index Fund

FZROX is a mutual fund that tracks the total U.S. stock market.

With a 0.00% expense ratio, FZROX is one of the cheapest index funds available.

The fund invests in approximately 3,000 U.S. stocks across all market capitalizations.

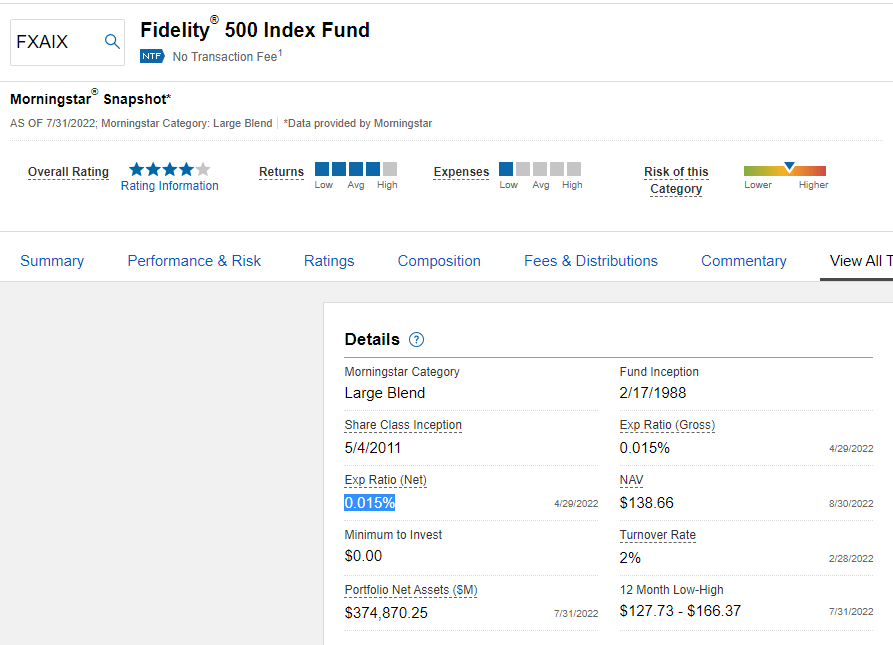

FXAIX: Fidelity 500 Index Fund

The Fidelity 500 Index Fund (FXAIX) is a mutual fund that tracks the performance of the S&P 500 Index, which is a market-capitalization-weighted index of 500 large-cap stocks.

FXAIX has a low expense ratio of 0.02%.

The fund’s portfolio is well diversified across different sectors, with the largest sector weightings being in technology, financials, and healthcare.

FZROX vs. FXAIX: Comparison Details

| Funds | Fidelity® ZERO Total Market Index Fund | Fidelity® 500 Index Fund |

|---|---|---|

| 3-year total return | +25.81% | +26.06% |

| 3-year standard deviation | 18.21% | 17.41% |

| Morningstar rating | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Min. initial investment | 0.00 | 0.00 |

| Net expense ratio | 0.00% | 0.02% |

| Total net assets | 13.26bn USD | 399.36bn USD |

| Symbol | FZROX | FXAIX |

| Morningstar category | Large Blend | Large Blend |

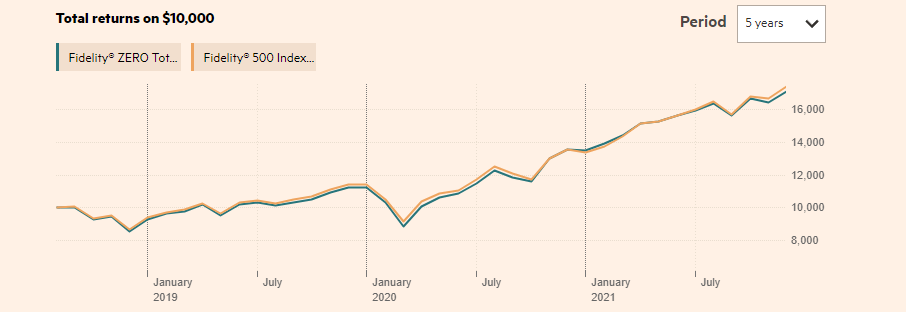

FZROX vs. FXAIX: Performance and Returns

Both FZROX and FXAIX are listed under Morningstar’s fund category of Large Blend. As a result, they have had similar holdings and performances over the years. But it’s not abnormal if one fund has a slight advantage over the other.

See how FZROX and FXAIX performed in the last 5 years.

| Funds | Fidelity® ZERO Total Market Index Fund | Fidelity® 500 Index Fund |

|---|---|---|

| 1 month | +3.97% | +4.48% |

| 3 months | +9.39% | +11.02% |

| 6 months | +9.39% | +11.66% |

| 1 year | +26.01% | +28.69% |

| 3 years | +25.81% | +26.06% |

| 5 years | — | +18.46% |

FZROX vs. FXAIX: What’s Better for a Roth IRA?

Joseph B wrote –– May 6, 2020

FZROX is “total” market and includes large cap, mid-cap, and small-cap… but it is still mostly large-cap because it is weighted by capitalization. FXAIX only includes large-cap in the S&P 500. There is quite a bit of overlap in these two mutual funds.

FZROX is more diversified, and it is one of Fidelity’s zero expense ratio funds. I think their overall performances are fairly similar given that they are cap weighted. Investing in both is probably unnecessary.

I think for the base of a retirement portfolio, I would lean toward FZROX because it includes some exposure to mid and small cap.