The investment industry has debated for years whether it’s better to invest in a total market index fund from Vanguard or Charles Schwab.

The debate generally pits SCHB and VTI against each other.

| Funds | Schwab U.S. Broad Market ETF | Vanguard Total Stock Market Index Fund ETF |

|---|---|---|

| 3-year total return | +11.74% | +11.75% |

| Morningstar rating | 4/5 | 4/5 |

| Min. initial investment | — | — |

| Net expense ratio | 0.03% | 0.03% |

| Total net assets | 20.36bn USD | 261.51bn USD |

| Symbol | SCHB | VTI |

SCHB: Schwab U.S. Broad Market ETF

The Schwab U.S Broad Market ETF (SCHB) seeks to track the total return of the U.S stock market, which is represented by the Dow Jones US Broad Stock Market Index.

Holdings: The index covers approximately 99% of the market capitalization of all U.S.-listed companies, including small, mid, and large-cap stocks.

Fees: SCHB has an expense ratio of 0.03%.

VTI: Vanguard Total Stock Market Index Fund

The Vanguard Total Stock Market Index Fund is an ETF that aims to track the CRSP US Total Market Index.

Holdings: The fund is made up of about 4,000 different stocks, which are weighted based on their market capitalization.

Fees: VTI has a relatively low expense ratio of 0.03%.

SCHB vs VTI: Key differences

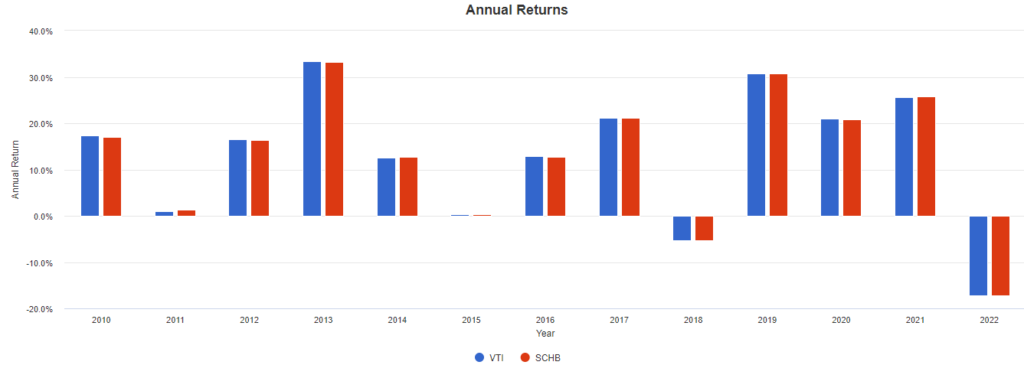

Both SCHB and VTI are exchange-traded funds (ETFs) that track similar indices.

The main difference between SCHB and VTI is that the former holds fewer stocks than the latter (2,500 vs. 4,076).

In other words, investors seeking a more diversified portfolio may prefer VTI over SCHB.

The total stock market index funds from Vanguard and Charles Schwab have the same expense ratio. Investors can expect identical returns from the two.

SCHB vs VTI: Which Fund Is a Better Investment?

As mentioned above, there are more similarities between SCHB and VTI than one can foresee. However, for starters, diversification is important. That said, there are more stocks in VTI than in SCHB.