VOO is an ETF from Vanguard that tracks the S&P 500, a large-cap index of 500 stocks from leading companies in various industries and sectors.

What Is the Fidelity Equivalent of VOO?

The Fidelity equivalent of VOO is the Fidelity 500 Index Fund (FXAIX).

FXAIX is passively managed—meaning it simply buys whatever stocks are included in the S&P 500 Index.

With an expense ratio of just 0.02%, FXAIX will help investors save even more money from their investments.

Top 10 holdings

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Apple Inc. | AAPL | 7.16% |

| Microsoft Corp. | MSFT | 6.01% |

| Amazon.com Inc. | AMZN | 3.38% |

| Tesla Inc. | TSLA | 2.14% |

| Alphabet Inc. Cl A | GOOGL | 2.00% |

| Alphabet Inc. Cl C | GOOG | 1.84% |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.56% |

| UnitedHealth Group Inc. | UNH | 1.46% |

| Johnson & Johnson | JNJ | 1.32% |

| NVIDIA Corp. | NVDA | 1.30% |

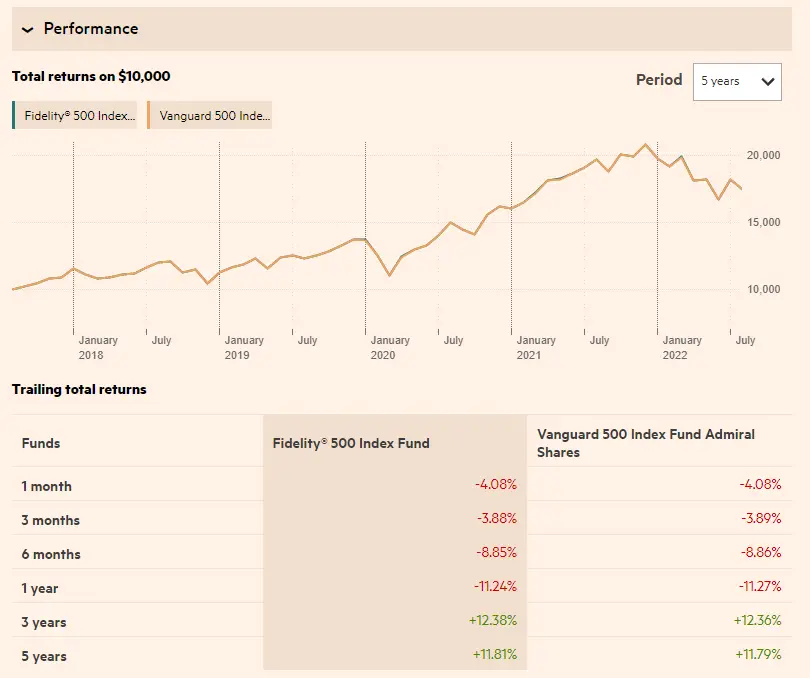

If you are looking for an alternative to Vanguard’s VOO, then Fidelity’s FXAIX is a good option. The fund has identical returns and fees as the S&P 500 ETF offered by Vanguard.

FNILX vs. FXAIX vs. VOO

Another good candidate is Fidelity’s Large Cap Index Fund (FNILX).

Like VOO and FXAIX, it holds the same stocks—but the difference is cost.

FNILX has no expense ratio, which means investors don’t have to pay a yearly fee to Fidelity.

The only downside is that FNILX is only available through Fidelity. If you’re using another brokerage to trade, you won’t be able to buy into this fund.