Accidentally opening 2 Roth IRA accounts on Fidelity can happen to the best of us. Whether it was a momentary lapse in attention or a technical glitch, it’s essential to know how to fix the situation without incurring any unnecessary fees or penalties.

In this guide, I’ll walk you through closing a duplicate Fidelity Roth IRA account.

Step 1: Assess the Situation

Before taking any action, ensure that the duplicate Roth IRA account is unfunded. This means there should be no funds or money deposited into it. If the account is indeed empty, proceed to the next step.

Step 2: Use Fidelity Virtual Assistant

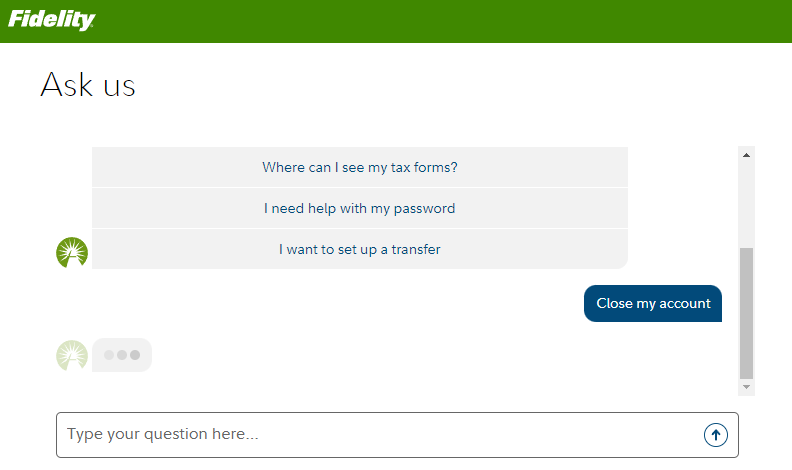

You can close your second Roth IRA account using the Virtual Assistance on the Fidelity website.

Simply visit Fidelity Virtual Assistant and type “Close my account.” This initiates the process of closing the unwanted account.

Alternatively, you can call customer service at 800-343-3548. Fidelity’s customer service team will guide you through the necessary steps to confirm the closure of the duplicate account. They’ll also reassure you that no fees or penalties will be incurred for this action.

Step 3: Hiding the Closed Account

After successfully closing the duplicate Roth IRA account, you may want to hide it from view on the Fidelity website.

Follow these steps:

- Navigate to your portfolio page.

- Select the gear icon (settings).

- Click on “Account Display Preferences.”

- Choose the account you wish to hide.

- Click “Save.”

The closed account will no longer appear in your portfolio.

In Summary

Accidents happen, and opening duplicate Roth IRA accounts is more common than you think. However, with Fidelity’s user-friendly Virtual Assistant and the steps outlined in this guide, resolving this issue is straightforward.

Remember, as long as the duplicate account is unfunded, there are no fees or penalties associated with its closure.