Holding cash on the sidelines in a Fidelity SPAXX money market account? You may be wondering how fed funds rate cuts impact your savings rate.

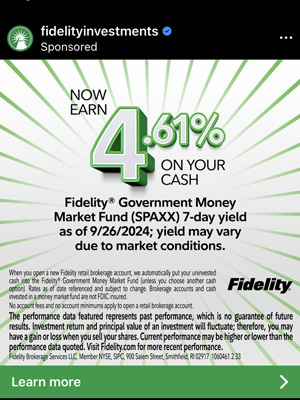

Fidelity’s SPAXX government money market fund is your Fidelity.com account’s cash sweep account, where your money is held before it’s deployed into buying stocks. Thru Fidelity’s bank partner UMB Bank (which you may have seen UMB NA Bank on your statements), the brokerage borrows money from the federal government at the fed funds rate, in turn, offering an interest rate yield (your savings rate) for keeping your money with Fidelity.

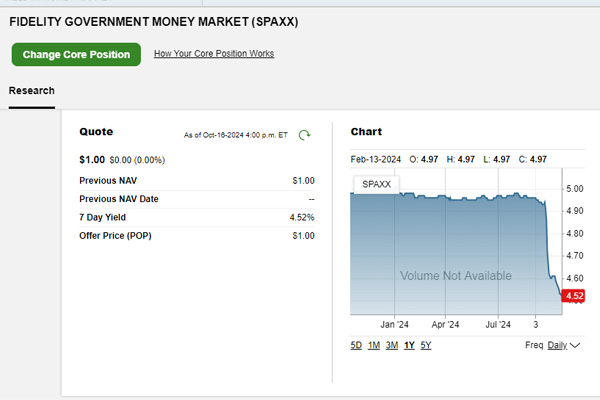

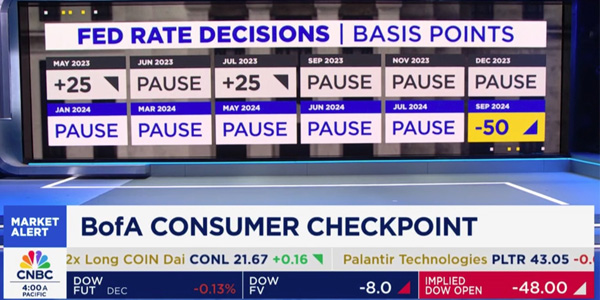

Following the Federal Reserve’s 9/19 meeting, Chairman Jay Powell announced the first rate cut following a period of 16-months where the fed funds rate had hovered above well-above 5%. This historical rate hike cycle began in March 2022 and peaked at 5.25-5.50% in July 2023, making it the fastest in history and largest in decades.

In turn, as the borrowing rate for national and regional banks increased, the products they offered consumers was equally high, from 8% 30-year mortgage rates to 9% car notes and credit cards with 20% APR’s (annual percentage rate). Conversely, for consumer households with a cash surplus, the high fed fund rate provided a short-term window for savers to earn a 5% risk-free rate of return with their money in lieu of investing in the stock market, real-estate, or alternative assets.

With a long-term monetary policy goal to lower the Fed funds rate to 3% by the end of 2025, a lower fed funds rate means you won’t be getting as much on your cash to sit not doing anything.

As of October 15, 2024, the list 7-day yield for SPAXX is in the range of 4.52% which excludes a .42% expense ratio to manage the government money market fund. Meaning, an investment of $10,000 will yield $34.16/mo based on the calculation of ((4.52% – .0042%) * $10,000)/12))

SPAXX Return Calculator

To calculate how much your savings in SPAXX will yield, head over to UseFidelity’s compound interest calculator tool, entering your investment amount with 4.10% as the interest rate, to see how much you could earn.

Getting Ahead of the 2025 Market Rotation

As we head into 2025, and market sentiment improves post-elections, it is strongly recommended that you consider putting your sideline money to work by investing in the stock market, or if it’s money you’ll need in a short-term horizon (6-months to 18-months), you should consider locking in higher rates in the form of long-term CD, short-term treasuries, or high-yield savings account with higher fixed rates.

Next article, we will explore investment ideas for rotating your cash into investment vehicles that will yield higher returns with increased risk, including Fidelity treasury bonds, floating rate fixed-income funds.