If you’re looking to buy an index fund that tracks the entire stock market, there are two main options: VTI and FZROX.

Both funds do a fantastic job of following broader markets.

In this article, we’ll explain why FZROX is the alternative to Vanguard’s VTI.

VTI: Vanguard Total Stock Market Index Fund ETF

VTI is the Total Stock Market ETF of Vanguard is an index fund with over 4,000 stocks. You can find small, mid, to large-cap stocks within the holdings of VTI. By investing this one ETF, your portfolio will have the exposure of the broad, global stock market.

What Is the Fidelity Equivalent of VTI?

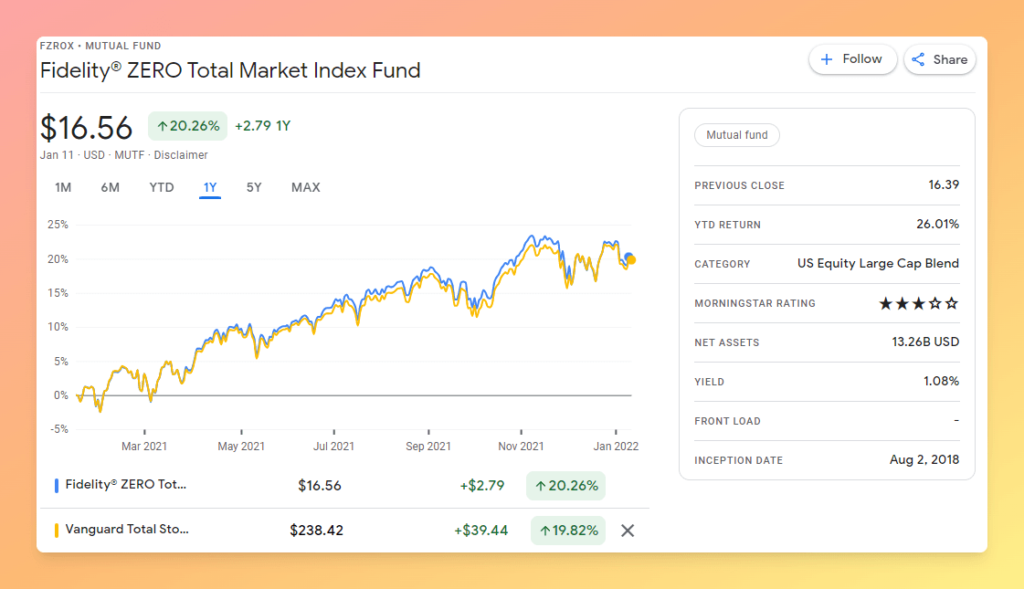

FZROX is the Fidelity version of VTI and you can only buy it on the Fidelity platform.

The fund tracks an index called Fidelity U.S. Total Investable Market Index.

Similar to VTI, the portfolio of FZROX contains more than 2,900 stocks.

TOP 10 HOLDINGS

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Apple Inc. | AAPL | 6.08% |

| Microsoft Corp. | MSFT | 5.11% |

| Amazon.com Inc. | AMZN | 2.87% |

| Tesla Inc. | TSLA | 1.82% |

| Alphabet Inc. Cl A | GOOGL | 1.71% |

| Alphabet Inc. Cl C | GOOG | 1.56% |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.32% |

| UnitedHealth Group Inc. | UNH | 1.24% |

| Johnson & Johnson | JNJ | 1.12% |

| NVIDIA Corp. | NVDA | 1.11% |

You can use either of these funds to diversify your portfolio, reduce risks, and minimize the constant volatility in the market today.

If you’re a Fidelity customer and want to invest in VTI but don’t have access to Vanguard funds, the Fidelity ZERO Total Market Index Fund (FZROX) is a great substitute.