Fidelity’s managed accounts come in tiers based on investment amount. Under $25K gets you a robo advisor, $50K-$250K a group advisor, and $500K and above a personal advisor. But the real question is, do they deliver?

Are Fidelity Managed Accounts Worth It?

Pros of a Fidelity Managed Account:

Expert Help: Fidelity’s got a team of pros ready to make smart money moves based on your goals and how much risk you can handle.

Lots of Choices: They’ve got a bunch of investment options, including their own funds, which can provide diversification benefits.

Stress-Free Investing: Fidelity’s managed accounts offer peace of mind for investors who prefer a hands-off approach, particularly during market volatility.

Potential for Solid Returns: Some users have reported impressive returns on their investments, showing the potential of Fidelity’s managed accounts.

Cons of a Fidelity Managed Account:

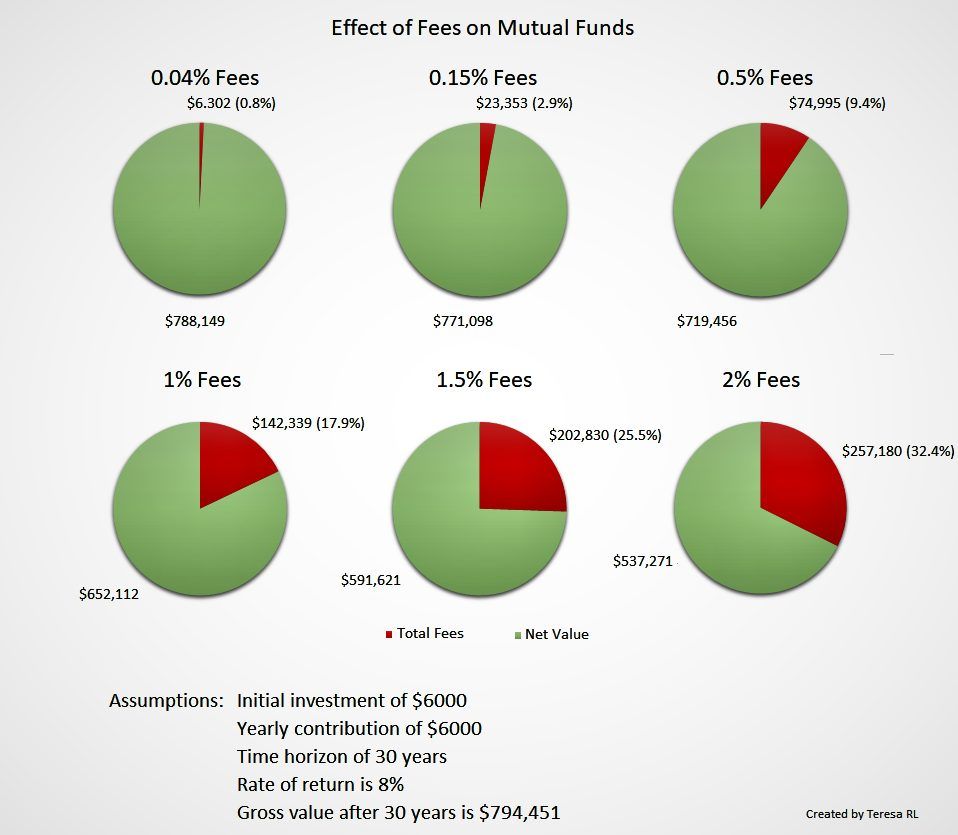

Management Fees: A Fidelity-managed account comes with associated fees, and they can potentially eat into your overall returns.

- For balances under $25,000, there is no advisory fee. For balances of $25,000 and above, there is an annual fee of 0.35%.

- Phone-based team of advisors (Minimum investment: $50,000 and Advisory fee: 1.10%)

- Partner with a dedicated advisor (General eligibility: $500,000 and Advisory fee: 0.50%–1.50%)

Performance Variability: As seen in discussions, performance can vary. Some users reported below-market returns.

Fidelity Wealth Management: What to Expect

User experiences with Fidelity Private Wealth Management advisory services vary.

For example, one user reported a 24% return on their IRA over a year. However, others have expressed dissatisfaction, noting little to no increase in value except for their own monthly contributions.

1. No, it’s not worth it. You can pick low-cost index funds, and you already paid yourself a 0.35-1.5 % premium.

2. When considering the 1.5% fee charged by Fidelity’s Wealth Management service, it’s essential to understand that it equates to a 25% cost on your investment. Avoid management as much as possible.

3. I spoke to an advisor and have decided to cancel advisory services. I can handle rebalancing myself, and I can call anytime for help if needed.

4. Fidelity’s advisors are not permitted to make specific investment recommendations. Despite this, they still charge an aggregate mixed management fee of 1.25% for assets under management of $1 million. This fee is not justified in a highly volatile market.

5. Put your money in Fidelity Freedom Target Index Funds. As you might with CDs, ladder your investments. Then watch the money grow. And remember the rule of 72. Divide 72 by the average yearly return. So at 10%, your money will double in 7.2 years.

In Summary

The decision to opt for a Fidelity’s managed account or wealth management services depends on your financial situation and investment preferences.

As you can see, the survey results are mixed, but it’s clear that many investors think Fidelity’s Wealth Management service is not worth the fee.